UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

Hannon Armstrong Sustainable Infrastructure Capital, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required |

|

Fee paid previously with preliminary materials |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

LETTER FROM THE CEO

Countries can and should improve their national security and climate security by scaling up investments in climate solutions.

Dear Stakeholders:

This annual letter was originally about how the integrity and rigor of our ESG approach produces tangible shareholder value due to high employee retention, which is crucial for solving client problems, building institutional memory, and achieving operating efficiencies. These are important advantages for our business.

But the tragic events unfolding in Ukraine cause me to go back to the beginning of my journey in the energy industry in the 1970s and remember the origins of energy efficiency, solar, and wind in the U.S. The twin Arab oil embargoes of 1973 and 1978 shocked the world, causing us all to realize how reliance on fossil fuels from unstable countries creates significant risk for economies and people. The price shocks launched the energy efficiency and renewable energy industries to reduce reliance on oil in the electric power and transport sectors. Fluorescent light bulbs, low-flow shower heads, and vehicle mileage standards were designed to make the U.S. more secure. We were driven not by the risk of climate change, but instead by the risk of supply shortages and price volatility.

The progress the clean energy business has made since the 1970s is built on the fundamental need to have secure energy supplies at reliable prices. The invasion of Ukraine by Russia is a reminder to Europe, and to a lesser extent the U.S., of the importance of controlling, as much as possible, a country’s energy supplies, lest one become beholden to hostile regimes. Europe’s reliance on Russian natural gas for heating buildings is a lesson not learned from the shocks of the 1970s. Heating buildings could be easily and more economically accomplished by the electrification of homes and buildings using heat pumps and distributed solar. Shutting down nuclear plants might make sense once Europe’s electric power needs have been secured with renewables and storage but is premature if still reliant on Russian natural gas. Energy security is national security.

In some respects, energy markets have been too stable since the 1970s, causing us to forget this fundamental lesson from history. In the very short term, like in times of war, worrying about climate change is a luxury.

But after the conflict ends, for better or for worse, the need to accelerate investments in climate solutions is even more obvious and urgent. A country can and should improve its national security and climate security by scaling up investments in climate solutions.

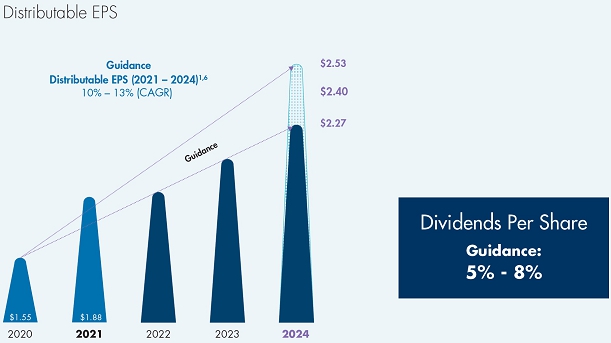

2021 Review and Outlook for 2022

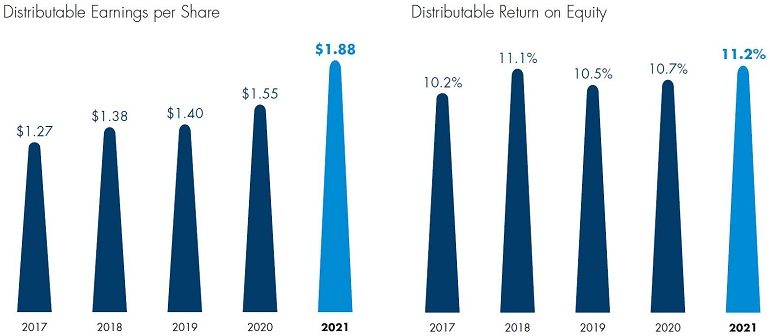

We invested more than $1.7 billion in climate solutions in 2021, resulting in a 24% increase in our Portfolio and a corresponding 52% increase in Distributable Net Investment Income. As a result, HASI continued its strong financial performance in 2021, increasing Distributable Earnings per Share by 21%. The market opportunity for climate solutions has never been larger, and we continue to see an attractive and diversified set of expanding markets in which to invest. Despite the well-noted supply chain and inflation issues impacting most industries, strong demand for climate solutions will continue for decades.

We invested heavily in talent and technology in 2021, increasing our capacity to grow our business and serve our clients. As a result, we maintained our Portfolio yield at 7.5% and expect it to remain attractive if interest rates move higher. We also reduced our average cost of funds, primarily driven by a large fixed-rate borrowing issued at a very low coupon and by obtaining a revolving line-of-credit and a first-of-its-kind CarbonCount®-based Commercial Paper program.

We look forward to strong growth in 2022 as our dual revenue business model continues to perform in the growing climate solutions investment market. HASI’s breadth of end markets generates diverse investment opportunities, increasing the stability of our business. As an example, our Portfolio of almost 300 discrete investments across all our end markets provides robust recurring revenue streams. Finally, the flexibility we enjoy in funding our liabilities, including our securitization platform, allows us to grow in any interest rate environment. Considering all of this, we increased and extended our Distributable Earnings guidance to 10%-13% through 2024. Given the strong earnings growth, our Board felt it appropriate to also raise our dividend by 7% in the first quarter of 2022.

Conclusion

Our hearts are with the people of Ukraine during this horrific war. Meanwhile, we will continue to expand our efforts in climate solutions investing, making the U.S. stronger while reducing our risks to climate change.

Respectfully,

Jeffrey W. Eckel

Chairman & CEO

April 2022

NOTICE OF 2022

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 2022

All stockholders are cordially invited to attend the Annual Meeting virtually. By hosting the Annual Meeting online, we are able to communicate more effectively with our stockholders, enable increased attendance and participation from locations around the world, and reduce costs, which aligns with our broader sustainability goals. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. Online check-in will begin at 9:15 a.m., Eastern time, and you should allow ample time for the online check-in procedures. During the upcoming virtual meeting, you may ask questions and will be able to vote your shares online from any remote location with Internet connectivity. We will respond to as many inquiries at the Annual Meeting as time allows.

|

|

|

| When | Place | Time |

| June 2, 2022 | Live webcast | 9:30 a.m. Eastern time |

| How to Vote | ||

| ONLINE | ||

| (During the Annual Meeting) | (Before the Annual Meeting) | |

| You may vote your shares during the meeting by accessing www.virtualshareholdermeeting ..com/HASI2022 (password: your 16 digit control number) and following the on-screen instructions. |

You may vote by going to www.proxyvote.com to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern time the day before the cut-off date or meeting date. | |

| TELEPHONE | ||

| Mark, sign and date your proxy card and return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. | |

Items to be voted on:

| 1 | Elect eight director nominees to serve on the Company’s board of directors |

| 2 | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 |

| 3 | Provide non-binding advisory approval of our executive compensation |

| 4 | Approve the 2022 Hannon Armstrong Sustainable Infrastructure Capital, Inc. Equity Incentive Plan |

| 5 | Such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof |

The attached Proxy Statement describes these items.

Notice Regarding the Availability of Proxy Materials

for the

Annual Meeting to be held June 2, 2022.

Our notice of annual meeting, proxy statement and 2021 Annual Report on Form 10-K are available at:

www.proxyvote.com

Our notice of annual meetings, proxy statement and 2021

Annual Report are also available on our website

www.investors.hannonarmstrong.com

Record Date

Close of business on April 7, 2022

By Order of our Board of Directors,

/s/ Steven L. Chuslo

Steven L. Chuslo

Secretary

Annapolis, Maryland

April 18, 2022

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 5 |

This summary highlights certain information from this Proxy Statement, but does not contain all the information that you should consider. Please read the entire Proxy Statement before voting your shares. For more complete information regarding our 2021 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2021.

|

|

|

||

| When June 2, 2022 9:30 a.m. Eastern Time |

Where The meeting will be held via a live webcast at www.virtualshareholdermeeting.com/HASI2022 (password: enter your 16 digit control number) |

Record

Date Close of business on April 7, 2022 |

The matters we will act upon at the Annual Meeting are:

| PROPOSAL | BOARD

OF DIRECTORS RECOMMENDATION |

More information | |

| Elect eight director nominees to serve on our board of directors until the Company’s 2023 annual meeting of stockholders and until their respective successors are duly elected and qualify |  |

FOR all nominees listed below | Page 10 |

| Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022 |  |

FOR | Page 40 |

| Approve, on a non-binding, advisory basis, the compensation of our named executive officers |  |

FOR | Page 42 |

| Approve the 2022 Hannon Armstrong Sustainable Infrastructure Capital, Inc. Equity Incentive Plan |  |

FOR | Page 68 |

| Name | Age | Independent | Principal occupation | Committees | Other public boards |

Director since | ||||||

| Jeffrey W. Eckel Chairman of the Board |

63 | Chief Executive Officer & President, Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 0 | Chairman since 2013 | ||||||||

| Teresa M. Brenner Lead Independent Director |

58 |  |

Retired Managing Director & Associate General Counsel, Bank of America Corporation | Compensation, NGCR (Chair) | 0 | 2016 Lead Independent Director since 2019 | ||||||

| Clarence D. Armbrister | 64 |  |

President, Johnson C. Smith University | NGCR | 0 | 2021 | ||||||

| Michael T. Eckhart | 73 |  |

Clinical Professor of Sustainable Finance, University of Maryland Adjunct Professor of Environmental Finance, Columbia University | NGCR, Finance and Risk | 0 | 2019 | ||||||

| Nancy C. Floyd | 67 |  |

Managing Director, Nth Power LLC | Audit, Finance and Risk | 1 | 2021 | ||||||

| Charles M. O’Neil | 69 |  |

Retired Chief Executive Officer and Chairman of the Board, ING Capital, LLC | Finance and Risk (Chair), NGCR | 0 | 2013 | ||||||

| Richard J. Osborne | 71 |  |

Retired Chief Financial Officer, Duke Energy Corporation | Audit, Compensation (Chair) | 0 | 2013 | ||||||

| Steven G. Osgood | 65 |  |

Chief Executive Officer, Square Foot Companies, LLC | Audit (Chair), Compensation | 1 | 2015 |

| 1) | Furnished as of April 7, 2022. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 6 |

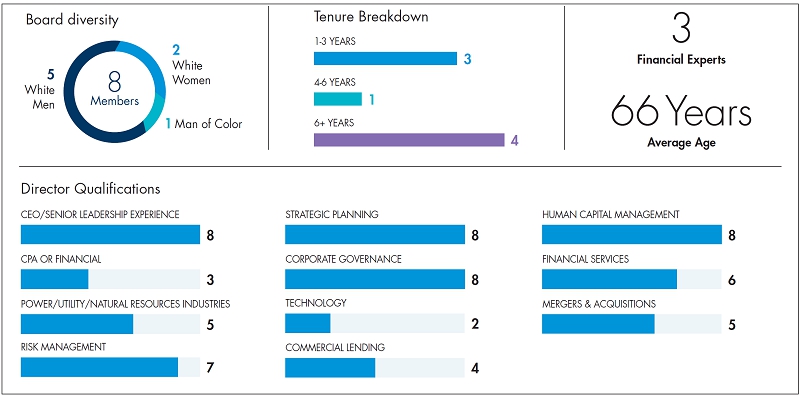

Our board of directors exhibits a strong mix of desired attributes, including business experience, tenure, age, diversity and independence. Three of eight current directors standing for re-election at the Annual Meeting have joined our board of directors since 2019, all of whom are independent directors. The following is a snapshot of some key characteristics of our board of directors immediately following the Annual Meeting assuming all nominees are elected.

| Stockholder Bylaws Amendments | In late 2021, our board of directors amended our Bylaws to permit stockholders to amend our bylaws by the affirmative vote of the holders of a majority of the outstanding shares of our common stock |

| ESG Governance | Robust oversight structure covering our strategies, activities, and policies including our Sustainability Investment Policy, Environmental Policies, and Human Rights and Human Capital Management Policies |

| Whistleblower Protections | In 2021, our board of directors reviewed our whistleblower protections to ensure best practices and anonymity |

| Pay for Performance Philosophy | Executive compensation encourages and rewards strong financial and operational performance |

| Implicit Link to ESG Performance | Executive compensation is implicitly linked to ESG performance due to our focus on investments in climate solutions, which drive growth in key compensation-linked financial metrics |

| CEO Pay Ratio | For 2021, the compensation for our chief executive officer was 34x the compensation of our median employee |

| New Equity Incentive Plan | Replaces “evergreen” provision contained in current equity incentive plan with a fixed pool of shares of our common stock available for awards under the plan, in addition to other improvements |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 7 |

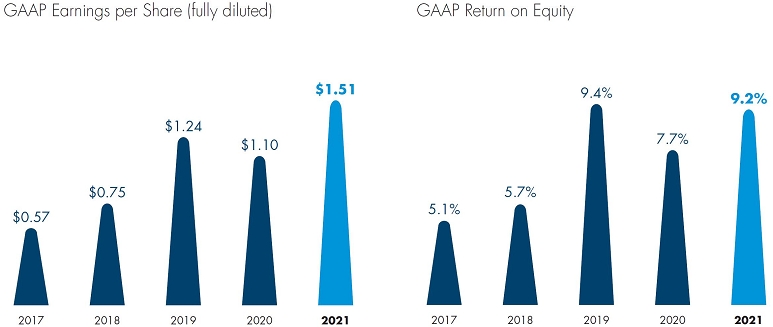

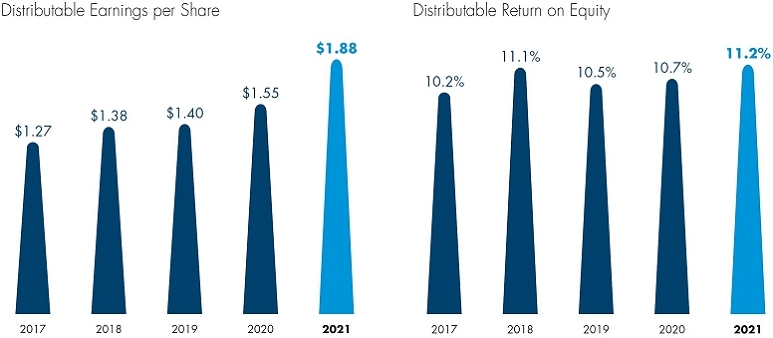

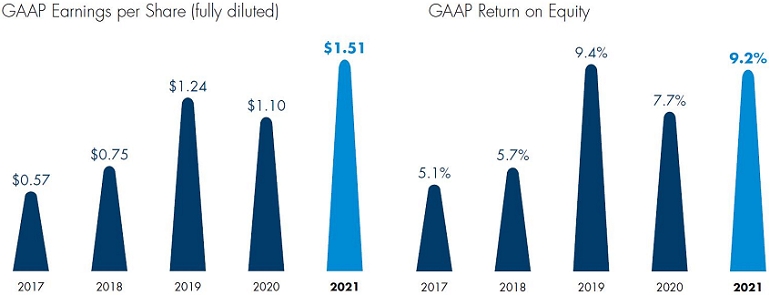

Key Performance Indicators

| FY21 | FY20 | Growth (YOY) | ||

| EPS | GAAP | $1.51 | $1.10 | |

| Distributable1 | $1.88 | $1.55 | +21% | |

| NII | GAAP-based | $11m | $29m | |

| Distributable1 | $134m | $88m | +52% | |

| Portfolio Yield1 | 7.5% | 7.6% | ||

| Portfolio2 | $3.6b | $2.9b | +24% | |

| Managed Assets1 | $8.8b | $7.2b | ||

| Distributable ROE3 | 11.2% | 10.7% | ||

| Pipeline | >$4b | >$3b | ||

| Transactions Closed | $1.7b | $1.9b |

Increase and Extension of Guidance

| 1) | See Item 7 to our Annual Report on Form 10-K, filed on February 22, 2022 with the SEC, for an explanation of Distributable Earnings, Distributable Net Investment Income, Portfolio Yield and Managed Assets, including reconciliations to the relevant GAAP measures, where applicable. |

| 2) | GAAP-based. |

| 3) | Distributable ROE is calculated using Distributable Earnings for the period and the average of the quarterly ending equity balances for the period. |

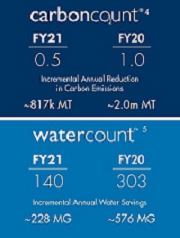

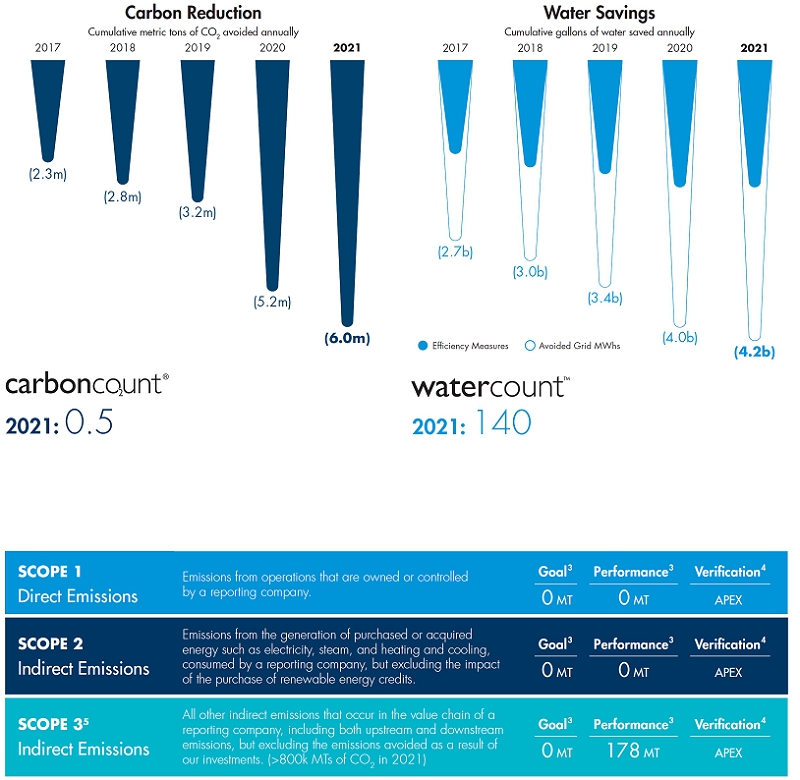

| 4) | CarbonCount is a scoring tool that evaluates investments in U.S.-based energy efficiency and renewable energy projects to estimate the expected CO2 emission reduction per $1,000 of investment. |

| 5) | WaterCount is a scoring tool that evaluates investments in U.S.-based projects to estimate the expected water consumption reduction per $1,000 of investment. |

| 6) | Relative to the 2020 baseline. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 8 |

| 1) | See Item 7 to our Annual Report on Form 10-K, filed on February 22, 2022 with the SEC, for an explanation of Distributable Earnings, Distributable Net Investment Income, Managed Assets, and Portfolio Yield, including reconciliations to the relevant GAAP measures, where applicable. |

| 2) | Distributable ROE is calculated using Distributable Earnings for the period and the average of the quarterly ending equity balances for the period. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 9 |

This proxy statement is being furnished to stockholders in connection with the solicitation of proxies by and on behalf of the board of directors of Hannon Armstrong Sustainable Infrastructure Capital, Inc., a Maryland corporation (the “Company,” “we,” “our” or “us”), for use at the Company’s 2022 annual meeting of stockholders (the “Annual Meeting”) to be held via a live webcast at www.virtualshareholdermeeting.com/HASI2022 (password: enter your 16-digit control number) on June 2, 2022, at 9:30 am, Eastern time, or at any postponements or adjournments thereof.

ELECTION OF DIRECTORS

Our board of directors is currently comprised of nine directors: Jeffrey W. Eckel, Clarence D. Armbrister, Teresa M. Brenner, Michael T. Eckhart, Nancy C. Floyd, Simone F. Lagomarsino, Charles M. O’Neil, Richard J. Osborne and Steven G. Osgood (the “director nominees”). In accordance with our charter (the “Charter”) and Amended and Restated Bylaws (the “Bylaws”), each director was elected at the 2021 Annual Meeting to hold office until the next annual meeting of stockholders and until his or her successor has been duly elected and qualifies, or until the director’s earlier resignation, death or removal.

Upon the recommendation of the Nominating, Governance and Corporate Responsibility Committee of our board of directors (the “NGCR Committee”), our board of directors has nominated eight of our current directors to stand for election as directors at the Annual Meeting based on the qualifications and experience described in the biographical information below. The procedures and considerations of the NGCR Committee in recommending qualified director nominees are described below under “—Identification of Director Candidates”. Each director nominee’s term will run until the next annual meeting of stockholders following the Annual Meeting and until their respective successors are duly elected and qualify.

Ms. Lagomarsino, whose term expires at the Annual Meeting, has elected not to stand for re-election at the Annual Meeting. Effective upon the expiration of Ms. Lagomarsino’s term, the size of our board of directors will be reduced from nine to eight directors. In connection with Ms. Lagomarsino’s decision not to stand for re-election at the Annual Meeting, the NGCR Committee and our board of directors have determined that it is in the best interest of the Company to appoint a racially or ethnically diverse woman to our board of directors. As a result, the NGCR Committee has initiated a search for a qualified candidate in accordance with our Corporate Governance Guidelines (the “Guidelines”) and its charter. If the NGCR Committee identifies and recommends a qualified candidate to our board of directors, and assuming our board of directors concurs with such nomination, our board of directors intends to increase the size of our board of directors from eight to nine and appoint such nominee to fill the resulting vacancy. See “—Identification of Director Candidates” and “—Vacancies”.

It is intended that the shares of our common stock, par value $0.01 per Share (the “Common Stock”) represented by properly submitted proxies will be voted by the persons named therein as proxy holders FOR the election of each of the director nominees listed in this Proxy statement unless otherwise instructed. See “—Voting on Director Nominees” below for more information.

|

Our board of directors recommends a vote FOR the election of each of the director nominees listed below. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 10 |

| JEFFREY W. ECKEL | ||

Age 63 Chair – Board of Directors since 2013 Chairman and Chief Executive Officer |

Mr. Eckel has served as chief executive officer, president and chairman of our board of directors since 2013 and was with the predecessor of our company as president and chief executive officer since 2000 and prior to that from 1985 to 1989 as a senior vice president. Mr. Eckel serves on the board of trustees of The Nature Conservancy of Maryland and DC. Mr. Eckel was appointed by the governor of Maryland to the board of the Maryland Clean Energy Center in 2011 where Mr. Eckel served until 2016 while also serving as its chairman from 2012 to 2014. Mr. Eckel has over 35 years of experience in financing, owning and operating infrastructure and energy assets. Mr. Eckel received a Bachelor of Arts degree from Miami University in 1980 and a Master of Public Administration degree from Syracuse University, Maxwell School of Citizenship and Public Affairs, in 1981. He holds Series 24, 63 and 79 securities licenses. We believe Mr. Eckel’s extensive experience in managing companies operating in the energy sector and expertise in energy investments make him qualified to serve as our president and chief executive officer and as chairman of our board of directors. | |

| TERESA M. BRENNER | ||

Age 58 Independent Director since 2016 Lead Independent Director since 2019 Committee: • NGCR Committee (Chair) • Compensation Committee |

Ms. Brenner retired from Bank of America Corporation in 2012, where she served in a variety of roles for approximately 20 years, including most recently as a managing director and associate general counsel Ms. Brenner served on the board of directors of Residential Capital, LLC from March 2013 to December 2013 during its restructuring and through the confirmation of its bankruptcy proceeding. Ms. Brenner is a member of the National Association of Corporate Directors, the Society of Corporate Governance, and the American Corporate Counsel Association, and is a member in good standing of the North Carolina State Bar. Ms. Brenner has also held a variety of philanthropic and civic roles, including serving as president of Temple Israel and chairperson of Right Moves for Youth. Ms. Brenner received a Bachelor of Arts degree magna cum laude and with honors in history from Alma College in 1984 where she was inducted into Phi Beta Kappa and a Juris Doctorate cum laude from Wake Forest University School of Law in 1987 where she was a Carswell Scholar and an editor of its Law Review. We believe Ms. Brenner’s extensive experience in corporate governance and corporate strategy, law and compliance, and finance and capital markets gives her valuable insight and enables her to make significant contributions as a member of our board of directors. | |

| CLARENCE D. ARMBRISTER | ||

Age 64 Independent Director since 2021 Committee: • NGCR Committee |

Mr. Armbrister has served as president of Johnson C. Smith University since January 1, 2018. Previously, Mr. Armbrister served as president of Girard College from 2012 to 2017. Mr. Armbrister has served as chair of the audit committee and a member of the compensation committee of Health Partners Plans Inc. since 2016. From 2008 to 2011, Mr. Armbrister served as chief of staff to the former Mayor of Philadelphia, Michael A. Nutter. Mr. Armbrister also served as senior vice president for administration and subsequently executive vice president and chief operating officer of Temple University from 2003 to 2007. Prior to that Mr. Armbrister served as vice president and director in the Municipal Securities Group and in other positions at PaineWebber & Co. (subsequently UBS PaineWebber Incorporated) from 1999 to 2003 and also served as an adjunct faculty member of the Beasley School of Law at Temple University from 1997 to 1998. From 1996 to 1998, Mr. Armbrister served as managing director of the Philadelphia School District and prior to that, in 1994, he was appointed Philadelphia City treasurer. From 1982 to 1994, Mr. Armbrister was an associate and then partner at Saul, Ewing, Remick & Saul (currently known as Saul Ewing Arnstein & Lehr LLP). Mr. Armbrister also serves on the boards of various organizations, including the board of directors for Health Partners Plan, the board of trustees of Devereux Advanced Behavioral Health and the board of Charlotte Regional Business Alliance. Mr. Armbrister is also a former member of the board of directors of the National Adoption Center and the Community College of Philadelphia’s board of trustees. Mr. Armbrister received a Bachelor of Arts degree in Political Science and Economics from the University of Pennsylvania in 1979 and a Juris Doctor degree from the University of Michigan Law School in 1982. We believe Mr. Armbrister’s over 35 years of experience in education, law, government and finance gives him valuable insight and enables him to make significant contributions as a member of our board of directors. | |

| 1) | Furnished as of April 7, 2022. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 11 |

| MICHAEL T. ECKHART | ||

Age 73 Independent Director since 2019 Committee: • Finance and Risk Committee • NGCR Committee |

Mr. Eckhart has served as a clinical professor of sustainable finance at the University of Maryland School of Public Policy since 2020, and also as an adjunct professor at Columbia University’s Graduate School of International and Policy Affairs, teaching Environmental Finance since 2016. In 2019, Mr. Eckhart retired as managing director and global head of Environmental Finance from Citigroup, Inc., where he led Citigroup Inc.’s work in establishing the Green Bond Principles. Prior to joining Citigroup in 2011, Mr. Eckhart was the founding president of the American Council on Renewable Energy, a Washington DC-based 501(c)(3) non-profit organization that unites finance, policy and technology to accelerate the transition to a renewable energy economy. He previously led the SolarBank Initiative in Europe, India and South Africa, and worked in power generation and advanced technology with United Power Systems, Aretê Ventures, General Electric Company and Booz, Allen & Hamilton. Prior to that, he also served in the U.S. Navy Submarine Service. He has received several awards including Renewable Energy Man of the Year of India, the Skoll Award for Social Entrepreneurship, and the International Solar Energy Society’s Global Policy Leadership Award. He is vice chairman of the Oyster Recovery Partnership in Maryland and a director of the International Solar Energy Society headquartered in Frieberg Germany. He received a Bachelor of Science degree in Electrical & Electronic Engineering from Purdue University and a Master in Business Administration from Harvard Business School. We believe Mr. Eckhart’s extensive experience in renewable energy and finance makes him qualified to serve as a member of our board of directors. | |

| NANCY C FLOYD | ||

Age 67 Independent Director since 2021 Committee: • Audit Committee • Finance and Risk Committee |

Ms. Floyd has served since 1993 as a managing director of Nth Power LLC, a venture capital firm she founded that specializes in clean energy technology. From 1989 to 1993, Ms. Floyd joined and started the technology practice for the utility consulting firm, Barakat and Chamberlain. From 1985 to 1988, Ms. Floyd was on the founding team and worked at PacTel Spectrum Services, a provider of network management services. In 1982, Ms. Floyd founded and later served as chief executive officer of NFC Energy Corporation, one of the first wind development companies in the United States. From 1977 to 1980, Ms. Floyd served as director of special projects of Vermont Public Service Board (currently known as Vermont Public Utility Commission). Ms. Floyd has also served on the boards of various organizations, including chair of the board and chair of the compensation committee of Tempronics, Inc. since 2014, member of the board of directors of First Fuel Inc. from 2014 to 2019, Glasspoint Solar from 2014 to 2020, chair of the audit committee of AltaGas Services and AltaGas Power Holdings (U.S.) Inc. (TSX: ALA) from 2018 to 2019, and member of the audit and governance committees of WGL Holdings, Inc. and Washington Gas (NYSE: WGL) from 2011 to 2018, among others. Also, since 2018, Ms. Floyd has served as fund advisor to Activate Capital and, since 2017, on the investment committee for The Christensen Fund. Ms. Floyd received a Bachelor of Arts degree in Government from Franklin & Marshall College in 1976 and a Master of Arts degree in Political Science from Rutgers University in 1977. We believe Ms. Floyd’s extensive experience in clean energy technology and utilities makes her qualified to serve as a member of our board of directors. | |

| CHARLES M. O’NEIL | ||

Age 69 Independent Director since 2013 Committee: • Finance and Risk Committee (Chair) |

Mr. O’Neil retired from ING Capital, LLC, at the end of 2015, where he served in a variety of executive and management roles for over 20 years, including as president, chief executive officer and chairman of the board of ING Capital, LLC and head of Structured Finance, Americas, the largest operating unit of ING Capital. Mr. O’Neil received a Bachelor of Science degree in Finance from The Pennsylvania State University in 1974 and a Master in Business Administration degree in International Finance from Fordham University in 1978. We believe Mr. O’Neil’s experience of over 35 years in structured and project finance focusing on energy related projects, combined with his senior management role with a large international bank’s wholesale banking activities in the Americas, makes him qualified to serve as a member of our board of directors. | |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 12 |

| RICHARD J. OSBORNE | ||

Age 71 Independent Director since 2013 Committee: • Compensation Committee (Chair) • Audit Committee |

Mr. Osborne retired from Duke Energy Corporation in 2006, having served in a variety of executive roles including chief financial officer, chief risk officer, treasurer and group vice president for Public & Regulatory Affairs during his 31 years with the organization. Mr. Osborne also served as a director of Duke Energy Field Services, a joint venture between Duke Energy Corporation and ConocoPhillips, and as a director of TEPPCO Partners, LP, a master limited partnership managing mid-stream energy assets. He also chaired the Finance Divisions of the Southeastern Electric Exchange and Edison Electric Institute, and was a founding board member of the Committee of Chief Risk Officers. Subsequent to leaving Duke Energy, Mr. Osborne executed consulting assignments for clients in, or serving, the energy industry. Mr. Osborne presently serves on the board of Chautauqua Institution and is chair of the board of trustees of Penland School of Craft. Mr. Osborne received a Bachelor of Arts degree in History and Economics from Tufts University in 1973 and a Master of Business Administration from the University of North Carolina at Chapel Hill in 1975. We believe that Mr. Osborne’s over 35 years of experience in energy sector finance makes him qualified to serve as a member of our board of directors. | |

| STEVEN G. OSGOOD | ||

Age 65 Independent Director since 2015 Committee: • Audit Committee (Chair) • Compensation Committee |

Mr. Osgood has served as the chief executive officer of Square Foot Companies, LLC, a Cleveland, Ohio based private real estate company focused on self-storage and single-tenant properties since 2008. Mr. Osgood is also a trustee for National Storage Affiliates Trust, a real estate investment trust (“REIT”) focused on the ownership of self-storage properties, since its public offering in April 2015. Mr. Osgood serves as chair of the finance committee for the company and on its audit committee. Prior to his current position, Mr. Osgood served as president and chief financial officer of U-Store-It Trust (now named CubeSmart), a self-storage REIT from the company’s initial public offering in 2004 to 2006. He also served as chief financial officer of several other REITs. Mr. Osgood is a former Certified Public Accountant. He graduated from Miami University with a Bachelor of Science degree in 1978 and graduated from the University of San Diego with a Masters in Business Administration in 1987. We believe that Mr. Osgood’s REIT experience and over 20 years of experience in corporate finance make him qualified to serve as a member of our board of directors. | |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 13 |

The NGCR Committee and our board of directors consider a broad range of factors when selecting nominees. We seek highly qualified director candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. We believe that, as a group, the director nominees bring a diverse range of perspectives that contribute to the effectiveness of our board of directors as a whole.

The table below represents some of the key skills and attributes that our board of directors has identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy, and the number of director nominees that have that skill or attribute. This director skills matrix is not intended to be an exhaustive list of each of our director nominees’ skills and attributes or contributions to our board of directors.

| SKILLS & EXPERTISE | ||||||||

| Experience | Eckel | Brenner | Armbrister | Eckhart | Floyd | O’Neil | Osborne | Osgood |

| Risk Management |  |

|

|

|

|

|

| |

| Capital Markets |  |

|

|

|

|

|

|

|

| CPA or Financial |  |

|

|

| ||||

| Power / Utility / Natural Resources Industries |  |

|

|

|

|

|||

| Financial Services |  |

|

|

|

|

|

||

| Strategic Planning |  |

|

|

|

|

|

|

|

| Technology |  |

|

||||||

| CEO/Senior Leadership Experience |  |

|

|

|

|

|

|

|

| Mergers & Acquisitions |  |

|

|

|

| |||

| Corporate Governance |  |

|

|

|

|

|

|

|

| Human Capital Management |  |

|

|

|

|

|

|

|

| Commercial Lending |  |

|

|

| ||||

| BACKGROUND | ||||||||

| Years on Board | 9 | 6 | 1 | 3 | 1 | 9 | 9 | 7 |

| Age | 63 | 58 | 64 | 73 | 67 | 69 | 71 | 65 |

| Gender Identification | M | F | M | M | F | M | M | M |

| African-American / Black |  |

|||||||

| Asian / South Asian | ||||||||

| White / Caucasian |  |

|

|

|

|

|

| |

| Hispanic / Latino | ||||||||

| Indigenous | ||||||||

| LGBTQ+ | ||||||||

| Veteran |  |

|||||||

| Disabled | ||||||||

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 14 |

In accordance with the Guidelines and its written charter, the NGCR Committee is responsible for identifying director candidates for our board of directors and for recommending director candidates to our board of directors for consideration as nominees to stand for election at our annual meetings of stockholders. Director candidates are recommended for nomination for election as directors in accordance with the procedures set forth in the written charter of the NGCR Committee.

As noted above, we seek highly qualified director candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. The NGCR Committee periodically reviews the appropriate skills and characteristics required of our directors in the context of the current composition of our board of directors, our operating requirements and the long-term interests of our stockholders. In accordance with the Guidelines, directors should possess the highest personal and professional ethics, integrity and values, exercise good business judgment, be committed to representing the long-term interests of the Company and our stockholders and have an inquisitive and objective perspective, practical wisdom and mature judgment. The NGCR Committee reviews director candidates with the objective of assembling a slate of directors that can best fulfill and promote our goals, taking into consideration personal factors and professional characteristics of each potential candidate, and recommends director candidates based upon contributions they can make to our board of directors and management and their ability to represent our long-term interests and those of our stockholders and other stakeholders.

The NGCR Committee evaluates the skill sets required for service on our board of directors and has developed a list of potential director candidates. If it is determined there is the need for additional or replacement board members, the NGCR Committee will assess potential director candidates included on the list as well as other appropriate potential director candidates based upon information it receives regarding such potential candidates or otherwise possesses, which assessment may be supplemented by additional inquiries. In conducting this assessment, the NGCR Committee considers knowledge, experience, skills, diversity and such other factors as it deems appropriate in light of our current needs and those of our board of directors. The NGCR Committee may seek input on director candidates from other directors. The NGCR Committee does not solicit director nominations, but it may consider recommendations by stockholders using the same criteria that it uses to evaluate other nominees. The NGCR Committee may, in its sole discretion, engage one or more search firms or other consultants, experts or professionals to assist in, among other things, identifying director candidates or gathering information regarding the background and experience of director candidates. The NGCR Committee will have sole authority to approve any fees or terms of retention relating to these services.

Our stockholders of record who comply with the advanced notice procedures set forth in our current Bylaws and outlined under the “Submission of Stockholder Proposals” section of this proxy statement may nominate candidates for election as directors. See “Submission of Stockholder Proposals” for information regarding providing timely notice of stockholder proposals under our Bylaws and the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”).

The Guidelines provide for a majority vote policy for the election of directors. Pursuant to this policy, in any uncontested election of directors, any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation to our board of directors following certification of the stockholder vote. The NGCR Committee shall promptly consider the resignation and make a recommendation to our board of directors with respect to the tendered resignation. In considering whether to accept or reject the tendered resignation, the NGCR Committee shall consider all factors it deems relevant, which may include the stated reasons, if any, why stockholders withheld votes from the director, any alternatives for curing the underlying cause of the withheld votes, the length of service and qualifications of the director, the director’s past and expected future contributions to the Company, the composition of our board of directors, and such other information and factors as members of the NGCR Committee shall determine are relevant. Our board of directors will act on the NGCR Committee’s recommendation no later than 90 days after the certification of the stockholder vote. Any director who tenders his or her resignation to our board of directors will not participate in the NGCR Committee’s consideration or board action regarding whether to accept such tendered resignation.

We will promptly disclose our board of director’s decision whether to accept the resignation as tendered (providing a full explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the tendered resignation) in a press release, a filing with the SEC or in another broadly disseminated means of communication.

In accordance with our Charter and Bylaws, any vacancies occurring on our board of directors, including vacancies occurring as a result of the death, resignation, or removal of a director, or due to an increase in the size of our board of directors, may be filled only by the affirmative vote of a majority of the directors remaining in office, even if the remaining directors do not constitute a quorum, and any director elected to fill a vacancy will serve for the remainder of the full term of the directorship in which the vacancy occurred and until a successor is duly elected and qualifies.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 15 |

A plurality of all the votes cast on the proposal at the Annual Meeting at which a quorum is present is necessary to elect a director. Proxies solicited by our board of directors will be voted FOR each director nominee unless otherwise instructed. Because directors are elected by a plurality of the votes cast in the election of directors, and no additional nominations may be properly presented at the Annual Meeting, ‘withhold’ votes will have no effect on the election of directors. Abstentions and broker non-votes are not votes and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. If the candidacy of any director nominee should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidates (if any) as shall be nominated by our board of directors. Our board of directors has no reason to believe that any nominee will be unable or unwilling to serve as a director.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 16 |

Our corporate governance philosophy is based on maintaining a close alignment of our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

| Our Board of Directors | Our Policies | Our Charter and Bylaws | Our Shareholder Engagement |

• We have a majority vote policy for the election of directors. • Our board of directors is not staggered. • Eight of our nine current directors are independent. • We have a Lead Independent Director. • Four directors qualify as an “audit committee financial experts” as defined by the SEC. • Three directors are women, constituting 33% of our board of directors. • We have established a target retirement age of 75 for our directors. • Our NGCR Committee oversees and directs our environmental, social and governance (“ESG”) strategies, activities, policies and communications. • We have a committee comprised of employees from across our organization that is focused on ESG strategies, policies and reports. |

• Our board members and NEOs are required to maintain certain levels of stock ownership in our company ranging between three and six times their base salary or retainer, depending on position. • Our Statement of Corporate Policy Regarding Equity Transactions prohibits our directors and officers from hedging our equity securities, holding such securities in a margin account or pledging such securities as collateral for a loan. • Our Clawback Policy provides for the possible recoupment of performance or incentive-based compensation in the event of an accounting restatement due to material noncompliance by us with any financial reporting requirements under the securities laws (other than due to a change in applicable accounting methods, rules or interpretations).

|

• We have opted out of the control share acquisition statute in the Maryland General Corporation Law (the “MGCL”). • We have exempted from the business combination statute in the MGCL transactions that are approved by our board of directors (including a majority of our directors who are not affiliates or associates of the acquiring person). • We do not have a stockholder rights plan (i.e., no poison pill). • Our stockholders have the concurrent right the amend our Bylaws.

|

• We have an active stockholder outreach program, including annually providing our stockholders the opportunity to vote on an advisory basis on the compensation of NEOs. |

In order to foster the highest standards of ethics and conduct in all business relationships, we have adopted a Code of Business Conduct and Ethics policy (the “Code of Conduct”). This policy, which covers a wide range of business practices and procedures, applies to our officers, directors, employees, agents, representatives, and consultants. In addition, our whistleblowing policy (the “Whistleblower Policy”) sets forth procedures by which any Covered Persons (as defined in the Whistleblower Policy) may report, on a confidential basis, concerns relating to any questionable or unethical accounting, internal accounting controls or auditing matters, as well as any potential Code of Conduct or ethics violations. We review these policies on a periodic basis with our employees.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 17 |

Our board of directors is responsible for overseeing our affairs and it conducts its business through meetings and actions taken by written consent in lieu of meetings. Pursuant to our Charter and Bylaws and the MGCL, our business and affairs are managed under the direction of our board of directors. Our board of directors has the responsibility for establishing broad corporate policies and for our overall performance and direction, but is not involved in our day-to-day operations, which are managed by our senior management team. Members of our board of directors keep informed of our business by participating in meetings of our board of directors and its committees, by reviewing analyses, reports and other materials provided to them and through discussions with the chairman of our board of directors, president and chief executive officer and other executive officers and other employees of the Company.

Our board of directors intends to hold at least four regularly scheduled meetings per year, generally one per calendar quarter, and additional special meetings as necessary.

Board of Directors Leadership Structure

Our board of directors has the flexibility to decide when the positions of chairman and chief executive officer should be held by one person or separated, and whether an executive or an independent director should be chairman. This allows our board of directors to choose the leadership structure that it believes will best serve the interests of our stockholders at any particular time. Currently, Mr. Eckel serves as the chairman of our board of directors and chief executive officer. In addition, our board of directors has an active Lead Independent Director, Teresa M. Brenner. Our board of directors believes that this leadership structure is best for the Company and its stockholders at this time.

In reaching the conclusion that the roles of the chairman and chief executive officer should be held by one person, our board of directors has considered the performance of the Company since its IPO as well as the views expressed by our stockholders and other constituents, both through stockholder votes and through direct outreach by management and our board of directors. Our board of directors concluded that Mr. Eckel is a well-seasoned leader with a proven track record of leading the Company over a long period of growth both before and after our IPO. Based on his and our track record, our board of directors determined that Mr. Eckel is the best person to continue to lead the Company and our board of directors. In his dual role, Mr. Eckel uses his extensive experience in managing companies operating in the energy sector and expertise in energy investments for over 35 years through many business cycles to guide the Company and our board of directors effectively and efficiently, including overseeing the Company’s strategies relating to ESG matters. He fulfills his responsibilities as chairman of our board of directors through close interaction with Ms. Brenner and the committee chairs.

Our board of directors also considered the actual board relationships and determined that there is actual and effective independent oversight of management by our supermajority independent board led by Ms. Brenner in her capacity as our Lead Independent Director. Ms. Brenner has served as our Lead Independent Director since 2019. Our board of directors believes that this board leadership structure, when combined with the functioning of the independent director component of our board of directors and our overall corporate governance structure, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs.

| ROLE OF THE LEAD INDEPENDENT DIRECTOR | |

TERESA M. BRENNER |

• Collaborate with the chairman and secretary to schedule meetings of our board of directors and to set meeting agenda • Ensure that matters of concern or interest to the independent directors are appropriately scheduled for discussion at board of directors meetings • Chair meetings in the absence of the chairman • Organize and preside over meetings and executive sessions of the independent directors • Serve as the principal liaison between the independent directors and the chairman on matters where the chairman may be conflicted • Together with the full board of directors, evaluate the performance of the chief executive officer/chairman and meet with the chief executive officer/chairman to discuss such evaluation • Authorize the retention of outside advisors and consultants who report directly to our board of directors • Meet regularly with the Chairman as well as each director • Along with management, periodically meet with institutional and other investors |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 18 |

Director Independence, Executive Sessions and Independent Oversight

The Guidelines provide that a majority of the directors serving on our board of directors must be independent as required by NYSE listing standards. In addition, as permitted under the MGCL, our board of directors has adopted certain independence standards (the “Independence Standards”) to assist it in making determinations with respect to the independence of directors. The Independence Standards are available for viewing on our website at www.hannonarmstrong. com. Based upon its review of all relevant facts and circumstances, our board of directors has affirmatively determined that eight of our nine current directors—Clarence Armbrister, Teresa Brenner, Michael Eckhart, Nancy Floyd, Simone Lagomarsino, Charles O’Neil, Richard Osborne and Steven Osgood—qualify as independent directors under the NYSE listing standards and the Independence Standards. There is no familial relationship, as defined under the SEC regulations, among any of our directors or executive officers.

The independent directors serving on our board of directors meet in executive sessions at least four times per year at regularly scheduled meetings of our board of directors and are active in the oversight of the Company. These executive sessions of our board of directors are presided over by our Lead Independent Director, Ms. Brenner. The independent directors oversee such critical matters as the integrity of our financial statements, the evaluation and compensation of executive officers and the selection and evaluation of directors. Each independent director has the ability to add items to the agenda of our board of directors meetings or raise subjects for discussion that are not on the agenda for that meeting.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 19 |

Committees

Our board of directors has four standing committees: the Audit Committee, the Compensation Committee, the Nominating, Governance and Corporate Responsibility Committee and the Finance and Risk Committee. Our committees are comprised solely of independent directors.

Audit Committee

Current Members

Steven Osgood (Chair) |

Primary Responsibilities • Engaging our independent registered public accounting firm. • Reviewing with the independent registered public accounting firm the plans and results of the audit engagement. • Approving professional services provided by the independent registered public accounting firm. • Reviewing the independence of the independent registered public accounting firm. • Considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. • Overseeing: • our and our subsidiaries’ corporate accounting and reporting practices, • the quality and integrity of our consolidated financial statements, • our compliance with applicable legal and regulatory requirements, • the performance, qualifications and independence of our external auditors, • the staffing, scope of work, performance, budget, responsibilities and qualifications of our internal audit function, including the engagement of outside advisors to assist our internal audit function. • Reviewing our policies with respect to risk assessment and risk management, which responsibility is shared with the Finance and Risk Committee. • Reviewing with management and external auditors our unaudited interim and audited annual financial statements as well as approving the filing of our financial statements • Meeting with officers responsible for certifying our annual report on Form 10-K or any quarterly report on Form 10-Q prior to any such certification and reviewing with such officers any disclosures related to any significant deficiencies or material weaknesses in the design or operation of internal controls. • Periodically discussing with our external auditors such auditors’ judgments about the quality, not just the acceptability, of our accounting principles as applied in our consolidated financial statements.

The specific responsibilities of the Audit Committee are set forth in its written charter, which is available for viewing on our website at www.hannonarmstrong.com.

Independence Our board of directors has determined that all of the members of the Audit Committee are independent as required by the NYSE listing standards, SEC rules governing the qualifications of Audit Committee members, the Guidelines, the Independence Standards and the written charter of the Audit Committee.

Financial Expertise and Literacy Our board of directors has also determined, based upon its qualitative assessment of their relevant levels of knowledge and business experience, that Mr. Osgood, Ms. Floyd, Ms. Lagomarsino and Mr. Osborne each qualify as an “audit committee financial expert” for purposes of, and as defined by, the SEC rules and each has the requisite accounting or related financial management expertise required by NYSE listing standards. In addition, our board of directors has determined that all of the members of the Audit Committee are financially literate as required by the NYSE listing standards.

Report The Audit Committee Report is set forth beginning on page 41 of this proxy statement. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 20 |

Compensation Committee

Current Members

Richard Osborne (Chair) |

Primary Responsibilities • Overseeing the approval, administration and evaluation of our compensation plans, policies and programs. • Reviewing the compensation of our directors and executive officers. • Overseeing regulatory compliance with respect to compensation matters. • Reviewing and approving and, when appropriate, recommending to our board of directors for approval, any employment agreements and any severance arrangements or plans for our executive officers. • Evaluating its relationship with any compensation consultant for any conflicts of interest and assessing the independence of any compensation consultant, legal counsel or other advisors.

The specific responsibilities of the Compensation Committee are set forth in its written charter, which is available for viewing on our website at www.hannonarmstrong.com.In April 2022, our board of directors amended the Compensation Committee charter to make the Compensation Committee primarily responsible for administering the 2022 plan and for making grants under the plan. See “Proposal No. 4 Vote to Approve the 2022 Hannon Armstrong Sustainable Infrastructure Capital, Inc. Equity Incentive Plan -- 2022 Plan Summary -- Administration.”

Independence Our board of directors has determined that each of the members of the Compensation Committee is independent as required by the NYSE listing standards, SEC rules, the Guidelines, the Independence Standards and the written charter of the Compensation Committee.

Compensation Consultant Since 2018, the Compensation Committee has engaged Pay Governance LLC (“Pay Governance”), a compensation consulting firm, to assist the Compensation Committee on the setting of certain annual bonus targets for our NEOs. In July 2019, the Compensation Committee also engaged Pay Governance to provide analysis and recommendations regarding (1) base salaries, annual bonuses and long-term incentive compensation for our executive management team, and (2) the director compensation program for non-employee members of our board of directors. Pay Governance was also engaged in March 2021 to evaluate the benefits of adopting a Diversity, Equity, Inclusion, Justice and Anti-Racism (“DEIJA”) policy as well as proposing various performance standards related to the promotion of such policy as it relates to the composition of the members of our board of directors and leadership team against which annual CEO compensation would be evaluated by our board of directors. Pay Governance reports directly to the Compensation Committee and the Compensation Committee has determined that Pay Governance is independent pursuant to the Company’s Compensation Committee charter.

Compensation Committee Interlocks and Insider Participation The Compensation Committee is comprised solely of independent directors. No member of the compensation committee is a current or former officer or employee of ours or any of our subsidiaries. Other than Mr. Eckel’s service both as an executive officer and as a member of our board of director, none of our executive officers serves as a member of the board of directors or compensation committee of any company that has one or more of its executive officers serving as a member of our board of directors or compensation committee.

Report The Compensation Committee Report is set forth beginning on page 56 of this Proxy Statement. |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 21 |

NGCR Committee

Current Members

Teresa Brenner (Chair)

|

Primary Responsibilities • Reviewing periodically and making recommendations to our board of directors on the range of qualifications that should be represented on our board of directors and eligibility criteria for individual board membership. • Seeking, considering and recommending to our board qualified candidates for election as directors and approving and recommending to the full board of directors the election of each of our officers and, if necessary, a lead independent director. • Reviewing and making recommendations on matters involving the general operation of our board of directors and our corporate governance and annually recommends nominees for each committee of our board of directors. • Reviewing the Company’s strategies, activities, policies, and communications regarding sustainability and other ESG related matters, including our CarbonCount® score, and making recommendations to our board of directors with respect thereto. • Annually facilitating the assessment of our board of directors’ performance as a whole and that of the individual directors and reports thereon to our board of directors

The specific responsibilities of the NGCR Committee are set forth in its written charter, which is available for viewing on our website at www.hannonarmstrong.com.

Independence Our board of directors has determined that each of the members of the NGCR Committee is independent as required by the NYSE listing standards, the Guidelines, the Independence Standards and the written charter of the NGCR Committee. |

Finance and Risk Committee

Current Members

Charles O’Neil (Chair)

|

Primary Responsibilities • Assessing, monitoring and overseeing matters relating to the Company’s financings. • Discussing and reviewing policies and guidelines with respect to our risk assessment and risk management for various risks, including, but not limited to, our interest rate, counter-party, credit, capital availability, refinancing and certain environmental risks. • Reviewing and assessing the adequacy of our insurance coverage. • Reviewing and assessing the adequacy of our cybersecurity policies and programs.

The specific responsibilities of the Finance and Risk Committee are set forth in its written charter, which is available for viewing on our website at www.hannonarmstrong.com. In October 2021, the Finance and Risk Committee charter was amended to remove a redundant requirement to review the terms of material debt financing transactions and recommend for subsequent review and approval by our board of directors. Our board of directors now reviews and approves material debt financing transactions.

Independence Our board of directors has determined that all of the members of the Finance and Risk Committee are independent under the NYSE listing standards, the Guidelines, the Independence Standards and the written charter of the Finance and Risk Committee.

|

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 22 |

We recognize the importance of understanding, evaluating, and monitoring ESG-related opportunities and risks as part of our vision and strategy. The NGCR Committee is responsible for periodically reviewing our strategies, activities, and policies including our Sustainability Investment Policy, Environmental Policies, and Human Rights and Human Capital Management Policies.

| ROLE | RESPONSIBILITIES |

| Board of Directors | Formal adoption of ESG strategy and policies and oversight of implementation |

| Nominating, Governance, and Corporate Responsibility Committee | Recommendation of new ESG policies and oversight of implementation |

| Chairman and CEO | Allocation, prioritization, and oversight of staff and company resources dedicated to the implementation of ESG initiatives |

| ESG Leadership Team | Reports to the Chairman and CEO and Nominating, Governance, and Corporate Responsibility Committee and responsible for informing strategy, setting performance milestones, and designating reponsibilities |

| Strategic Initiatives and ESG | Development of ESG strategy, execution of initiatives, and integration of engagement with ESG rating agencies, ESG-focused investors, and other stakeholders |

| Accounting | Tracking, verifying, and reporting ESG (including PCAF-aligned emissions metrics) metrics in public financial filings |

| Legal | Review of ESG disclosures and ensuring validation of adherence to ESG policies |

| Human Resources | Development and implementation DEIJA principles in employee recruitment, retention, promotion, and engagement initiatives |

| Hannon Armstrong Foundation Leadership Team | Development and implementation of corporate philanthropic strategy |

| Diversity, Equity, Inclusion, Justice, and Anti-Racism (DEIJA) Working Group | Development and implementation of DEIJA initiatives |

| TCFD Committee | Assessment of how climate change-related risks and opportunities impact investments |

| Capital Markets | Execution of green and CarbonCount-based debt issuances |

| Investor Relations | Collection of investor feedback on ESG performance and initiatives |

| Investments | CarbonCount assessments and monitoring of climate investment risks and opportunities |

| Communications | Fostering and maintaining authentic and strategic stakeholder relationships in support of ESG strategy |

| Portfolio Management | Assessment of portfolio exposure to climate risks and opportunities |

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 23 |

For

Your Reference

For additional information on our ESG strategy, policies, and initiatives (including the below documents), please visit investors.hannonarmstrong.com and www.hannonarmstrong.com/ESG.

• Annual Report

• Sustainability Investment Policy

• Environmental Policies

• Human Rights & Human Capital Management Policies

• Code of Business Conduct and Ethics

• Business Partner Code of Conduct

• Environmental Metrics

• Sustainability Report Card |

Risk Oversight

In connection with their oversight of risk to our business, our board of directors considers feedback from management concerning the risks related to our business, operations and strategies. The Finance and Risk Committee of our board of directors has the responsibility to discuss and review policies with respect to our risk assessment and risk management, including, but not limited to, guidelines and policies to govern the process by which risk assessment and risk management is undertaken, the adequacy of our insurance coverage, our interest rate risk management, our counterparty and credit risks, our capital availability, our refinancing risks, and our cybersecurity risk. The Audit Committee also consults with the Finance and Risk Committee on certain of these matters. Management regularly reports to our board of directors on our leverage policies, our asset acquisition process, any asset impairments and our compliance with applicable REIT and Investment Company Act of 1940, as amended, rules. Members of our board of directors routinely meet with management in connection with their consideration of matters submitted for the approval of our board of directors and the risks associated with such matters.

Cybersecurity

We recognize how critical cybersecurity and cyber resilience are to the well-being of our organization, our business stakeholders, and the information we rely on to profitably operate. The proliferation of global cyber risks continually transforms the cyber risk landscape, which requires our cybersecurity and training programs to constantly adapt and evolve, under the strategic direction of the Finance and Risk Committee.

Identifying and addressing these cyber threats while upholding our principles of governance, internal controls, and transparency is a priority for our cybersecurity program. The Finance and Risk Committee and management collectively provide oversight of our information technology and cybersecurity program, which is led by our chief technology officer and supported by a skilled and high performing team of technology professionals.

Our focused cyber and information security strategy incorporates components of the National Institute of Standards and Technology Cybersecurity Common Standards Framework, certain Center for Internet Security benchmarks, as well as Information Technology Library components to suit our organization’s unique cybersecurity needs. Our deliberately limited disclosure of specific framework alignments is meant to minimize risks to our IT security.

Our IT infrastructure deploys a best-in-class technology stack supported by proven vendors whose services address the range of risks identified by the Finance and Risk Committee and internal cybersecurity apparatus.

Annual Board of Directors and Committee Assessments

Our board of directors and each of its committees conducts an annual self-assessment process, implemented and overseen by our NGCR Committee in order to review the effectiveness of our board of directors and its committees. The formal self-evaluation may be in the form of written or oral questionnaires and may be administered by board members and/or by third parties, as determined appropriate by our NGCR Committee for the related performance cycle. Director feedback is solicited at both the board and committee levels. The results of our board of directors and committee self-assessments are compiled and presented to our board of directors, and items identified in the self-assessments requiring follow-up are monitored on an ongoing basis by our board of directors and by management. In addition to the formal annual board and committee evaluation process, our Lead Independent Director speaks with each board member at least quarterly, and receives input regarding board and committee practices and management oversight. Throughout the year, committee members also have the opportunity to provide input directly to committee chairs or to management.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 24 |

Director Attendance

The following table shows director attendance, either in person, telephonically or via videoconference, at meetings of our board of directors and of the committees of our board of directors for the period from January 1, 2021 through December 31, 2021:

| Number of Meetings | Attendance(1) | ||

| Board of Directors | 8 | 100% | |

| Audit Committee | 8 | 100% | |

| Compensation Committee | 8 | 100% | |

| Finance & Risk Committee | 5 | 100% | |

| NGCR Committee | 8 | 93% |

| (1) | Mr. Armbrister and Ms. Floyd joined our board of directors in March 2021. As a result, solely with respect to the attendance of Mr. Armbrister and Ms. Floyd, this information reflects their attendance since their appointment to our board of directors. |

All the directors then serving on our board of directors attended our 2021 virtual annual meeting of stockholders and all directors currently serving on our board of directors intend to attend our Annual Meeting. Our board of directors’ policy, as set forth in the Guidelines, is to encourage and promote the attendance by each director at all scheduled meetings of our board of directors and all meetings of our stockholders.

Code of Business Conduct and Ethics

Our board of directors has adopted the Code of Conduct, which applies to our directors, executive officers, employees, agents, representatives, and consultants. The Code of Conduct was designed to assist in complying with the law, in resolving moral and ethical issues that may arise and in complying with our policies and procedures. Among the areas addressed by the Code of Conduct are compliance with applicable governmental, state and local laws, compliance with securities laws, the use and protection of company assets, data privacy, the protection of our confidential corporate information, dealings with the press and communications with the public, internal accounting controls, improper influence of audits, records retention, fair dealing, discrimination and harassment, health and safety, and conflicts of interest, including payments and gifts by third parties, outside financial interests that might be in conflict with our interests, access to our confidential records, corporate opportunities, and loans. The Code of Conduct is available for viewing on our website at www. hannonarmstrong.com. We will also provide the Code of Conduct, free of charge, to stockholders who request it. Requests should be directed to Steven L. Chuslo, our executive vice president, chief legal officer and secretary, at Hannon Armstrong Sustainable Infrastructure Capital, Inc., 1906 Towne Centre Blvd, Suite 370, Annapolis, Maryland 21401.

Corporate Governance Guidelines

Our board of directors has adopted the Guidelines that address significant issues of corporate governance and set forth procedures by which our board of directors carries out its responsibilities. Among the areas addressed by the Guidelines are the composition of our board of directors, its functions and responsibilities, its standing committees, director qualification standards, access to management and independent advisors, director compensation, management succession, director orientation and continuing education and the annual performance evaluation and review of our board of directors and committees. The Guidelines are available for viewing on our website at www.hannonarmstrong.com. We will also provide the Guidelines, free of charge, to stockholders who request it. Requests should be directed to Steven L. Chuslo, our executive vice president, chief legal officer and secretary, at Hannon Armstrong Sustainable Infrastructure Capital, Inc., 1906 Towne Centre Blvd, Suite 370, Annapolis, Maryland 21401.

Whistleblower Policy

Our Whistleblower Policy sets forth procedures by which any Covered Persons (as defined in the Whistleblower Policy) may report, on a confidential basis, concerns relating to any questionable or unethical accounting, internal accounting controls or auditing matters, as well as any potential Code of Conduct or ethics violations. We maintain a confidential hotline for reporting potential violations. All reports will be taken seriously, we will fully investigate each allegation and, when appropriate, take appropriate action. Reports are sent solely to the chair of the Audit Committee, the chair of the NGCR Committee and the chief legal officer (unless such person is the subject of the applicable report). In 2021, our board of directors reviewed and made minor changes to our whistleblower procedures to ensure compliance with industry best practices and whistleblower anonymity. Since our IPO in 2013, we have never received any whistleblower reports.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 25 |

Personal Loans to Executive Officers and Directors

We comply with, and operate in a manner consistent with, applicable law prohibiting extensions of credit in the form of personal loans to or for the benefit of our directors and executive officers.

Corporate Governance Review

In overseeing our corporate policies and our overall performance and direction, our board of directors has adopted the approach of operating in what it believes are the long-term best interests of the Company and our stockholders. In operating under these principles, our board of directors continuously reviews our corporate governance structure and considers whether any changes are necessary or desirable.

We believe that engaging with investors is fundamental to our commitment to good governance and essential to maintaining our industry-leading practices. Throughout the year, we seek opportunities to connect with our investors to gain and share valuable insights into current and emerging business and governance trends.

In 2021, we met with over 190 investors, representing over 50% of our shares of Common Stock outstanding as of the end of the year.

Topics discussed include our investment criteria, interest rate and other risk management practices, political and regulatory matters and our focus on sustainability and strong governance practices, including with respect to allowing our stockholders to amend our Bylaws. These meetings were conducted in person, via teleconference, via videoconference or one-on-one at industry conferences. Our engagement activities take place throughout the year and we also conduct quarterly earnings calls where we try to answer many of the new questions that we receive during our investor outreach.

The table below provides an example of stockholder feedback that led to boardroom discussion and action:

| Message | Action | |

| A provision in our Bylaws was not in line with ESG best practices. This legacy provision gave our board of directors the exclusive power to adopt, alter, or repeal any provision of our Bylaws and make new Bylaws. |  |

Our board of directors determined in late 2021 that it is in our stockholders’ best interests to amend Article XIV of our Bylaws to permit stockholders to amend our Bylaws, other than the provisions requiring indemnification of our directors and officers and the provisions governing amendments of our Bylaws, by the affirmative vote of the holders of a majority of the outstanding shares of Common Stock pursuant to a binding proposal submitted by a stockholder that satisfies the ownership and other eligibility requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the periods and as of the dates specified therein upon notice duly given in accordance with our Bylaws. Previously, Article XIV provided that our board of directors had the exclusive power to adopt, alter or repeal any provision of the Bylaws and to make new Bylaws. |

Our board of directors recognizes that management succession planning is a fundamental and ongoing part of its responsibilities. Our NGCR Committee has utilized a framework relating to executive succession planning under which the NGCR Committee has defined specific criteria for, and responsibilities of, each of the executive officer roles of the Company. The NGCR Committee then focuses on the skill set needed to succeed in these roles both on a long-term and an emergency basis. Our Lead Independent Director also meets on this topic separately with our chief executive officer and facilitates additional discussions with our independent directors about executive succession planning throughout the year, including at executive sessions. Succession planning remains a priority for our NGCR Committee, which has worked with Mr. Eckel to ensure an appropriate emergency succession protocol and to develop our long-term succession plan.

| HANNON ARMSTRONG | 2022 PROXY STATEMENT | | 26 |

Our board of directors has approved a process to enable communications with the independent members of our board of directors or the chair of any of the committees of our board of directors. Communications by email should be sent to legaldepartment@ hannonarmstrong.com. Communications by regular mail should be sent to the attention of Steven L. Chuslo, our executive vice president, chief legal officer and secretary, at our office at 1906 Towne Centre Blvd, Suite 370, Annapolis, MD 21401. Each communication received will be reviewed to determine whether the communication requires immediate action. All appropriate communications received, or a summary of such communications, will be sent to the appropriate member(s) of our board of directors. However, we reserve the right to disregard any communication we determine is unduly hostile, threatening, illegal, does not reasonably relate to us or our business, or is similarly inappropriate. Our secretary, or his or her delegate, has the authority to disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications.