0001561894DEF 14Afalse00015618942023-01-012023-12-310001561894hasi:JeffreyW.EckelMember2023-01-012023-12-31iso4217:USD0001561894hasi:JeffreyA.LipsonMember2023-01-012023-12-31iso4217:USDxbrli:shares0001561894hasi:JeffreyW.EckelMember2022-01-012022-12-3100015618942022-01-012022-12-310001561894hasi:JeffreyW.EckelMember2021-01-012021-12-3100015618942021-01-012021-12-310001561894hasi:JeffreyW.EckelMember2020-01-012020-12-3100015618942020-01-012020-12-310001561894hasi:ChangeInPensionValueMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:ChangeInPensionValueMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:ChangeInPensionValueMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:ChangeInPensionValueMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:ChangeInPensionValueMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:JeffreyA.LipsonMemberhasi:StockAwardsAdjustmentsMemberecd:PeoMember2023-01-012023-12-310001561894hasi:JeffreyA.LipsonMemberhasi:PensionAdjustmentsServiceCostMemberecd:PeoMember2023-01-012023-12-310001561894hasi:EquityAwardAdjustmentsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:JeffreyA.LipsonMember2022-01-012022-12-310001561894hasi:ChangeInPensionValueMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:JeffreyA.LipsonMemberhasi:StockAwardsAdjustmentsMemberecd:PeoMember2022-01-012022-12-310001561894hasi:JeffreyA.LipsonMemberhasi:PensionAdjustmentsServiceCostMemberecd:PeoMember2022-01-012022-12-310001561894hasi:EquityAwardAdjustmentsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:JeffreyA.LipsonMember2021-01-012021-12-310001561894hasi:ChangeInPensionValueMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:JeffreyA.LipsonMemberhasi:StockAwardsAdjustmentsMemberecd:PeoMember2021-01-012021-12-310001561894hasi:JeffreyA.LipsonMemberhasi:PensionAdjustmentsServiceCostMemberecd:PeoMember2021-01-012021-12-310001561894hasi:EquityAwardAdjustmentsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:JeffreyA.LipsonMember2020-01-012020-12-310001561894hasi:ChangeInPensionValueMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894hasi:JeffreyA.LipsonMemberhasi:StockAwardsAdjustmentsMemberecd:PeoMember2020-01-012020-12-310001561894hasi:JeffreyA.LipsonMemberhasi:PensionAdjustmentsServiceCostMemberecd:PeoMember2020-01-012020-12-310001561894hasi:EquityAwardAdjustmentsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894us-gaap:PensionPlansDefinedBenefitMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894us-gaap:PensionPlansDefinedBenefitMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894us-gaap:PensionPlansDefinedBenefitMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894us-gaap:PensionPlansDefinedBenefitMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMemberhasi:JeffreyW.EckelMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMemberhasi:JeffreyW.EckelMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMemberhasi:JeffreyW.EckelMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMemberhasi:JeffreyW.EckelMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:JeffreyA.LipsonMemberhasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:JeffreyA.LipsonMemberhasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:JeffreyA.LipsonMemberhasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894hasi:JeffreyA.LipsonMemberhasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberhasi:JeffreyA.LipsonMemberecd:PeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001561894hasi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-01-012020-12-310001561894hasi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-31000156189412023-01-012023-12-31000156189422023-01-012023-12-31000156189432023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

| | | | | |

Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Hannon Armstrong Sustainable

Infrastructure Capital, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

Payment of Filing Fee (Check all boxes that apply): |

| ☑ | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2024 Annual

Meeting of Stockholders

| | | | | | | | | | | | | | |

| | | | |

| | | | |

When June 6, 2024 9:30 a.m. Eastern Time | | Where The meeting will be held via a live webcast at www.virtualshareholdermeeting.com/HASI2024 (password: enter your 16 digit control number) | | Record Date Close of business on March 21, 2024 |

| | | | |

| | | | | |

| |

| How to Vote |

ONLINE (During the Annual Meeting) Access www.virtualshareholdermeeting.com/HASI2024 (password: your 16 digit control number) and follow the on-screen instructions. | (Before the Annual Meeting) Go to www.proxyvote.com to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. |

| |

MAIL Mark, sign and date your proxy card and return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | TELEPHONE 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. |

| |

All stockholders are cordially invited to attend the Annual Meeting virtually. By hosting the Annual Meeting online, we are able to communicate more effectively with our stockholders, enable increased attendance and participation from locations around the world, and reduce costs, which aligns with our broader sustainability goals. The virtual meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. Online check-in will begin at 9:15 a.m., Eastern Time, and you should allow ample time for the online check-in procedures. During the upcoming virtual meeting, you may ask questions and will be able to vote your shares online from any remote location with internet connectivity. We will respond to as many inquiries at the Annual Meeting as time allows.

Items to be voted on:

| | | | | | | | |

| 1 | | Elect ten director nominees to serve on our board of directors |

| | |

| 2 | | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 |

| | |

| 3 | | Provide non-binding advisory approval of our executive compensation |

| | |

| 4 | | Approval of the conversion of the Company from a Maryland corporation to a Delaware corporation under the name “HA Sustainable Infrastructure Capital, Inc.” in accordance with the Plan of Conversion attached to the accompanying proxy statement |

| | |

| 5 | | Such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof |

| | |

The attached proxy statement describes these items. Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held June 6, 2024. Our notice of annual meeting, proxy statement and 2023 Annual Report on Form 10-K are available at: www.proxyvote.com and www.investors.HASI.com. |

By Order of our Board of Directors,

/s/ Steven L. Chuslo

Steven L. Chuslo

Secretary

Annapolis, Maryland

April 15, 2024

| | | | | |

HASI Proxy Statement 2024 | 1 |

Proxy Statement Table of Contents

| | | | | |

2 | HASI Proxy Statement 2024 |

Proxy Summary

This summary highlights certain information from this Proxy Statement, but does not contain all the information that you should consider. Please read the entire Proxy Statement before voting your shares. For more complete information regarding our 2023 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2023.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

When June 6, 2024 9:30 a.m. Eastern Time | | Where The meeting will be held via a live webcast at www.virtualshareholdermeeting.com/HASI2024 (password: enter your 16 digit control number) | | Record Date Close of business on March 21, 2024 |

| | | | |

Meeting Agenda

The matters we will act upon at the Annual Meeting are:

| | | | | | | | | | | |

| PROPOSAL | BOARD OF DIRECTORS RECOMMENDATION | MORE INFORMATION |

Elect ten director nominees to serve on our board of directors until the Company’s 2025 annual meeting of stockholders and until their respective successors are duly elected and qualify | | FOR all nominees listed below | |

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024 | | FOR | |

Approve, on a non-binding, advisory basis, the compensation of our named executive officers | | FOR | |

Approval of the conversion of the Company from a Maryland corporation to a Delaware corporation under the name “HA Sustainable Infrastructure Capital, Inc.” in accordance with the Plan of Conversion attached to the accompanying proxy statement | | FOR | |

Director Nominees1

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Independent | Principal occupation | Committees | Other public boards | Director since |

Jeffrey W. Eckel Executive Chair | 65 | | Former Chief Executive Officer & President, Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | 0 | Executive Chair since March 2023; Chair from 2013 to February 2023; Director since 2013 |

Jeffrey A. Lipson Chief Executive Officer | 56 | | Chief Executive Officer & President, Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | 0 | 2023 |

Teresa M. Brenner Lead Independent Director | 60 | | Former Managing Director & Associate General Counsel, Bank of America Corporation | Compensation, NGCR (Chair) | 0 | Lead Independent Director since 2019; Director since 2016 |

| Lizabeth A. Ardisana | 71 | | Chief Executive Officer & Principal Owner, ASG Renaissance, LLC | Audit, Compensation | 2 | 2022 |

| Clarence D. Armbrister | 66 | | Former President, Johnson C. Smith University | NGCR, Finance and Risk | 0 | 2021 |

| Nancy C. Floyd | 69 | | Former Managing Director, Nth Power LLC | Audit, Finance and Risk | 0 | 2021 |

| Charles M. O’Neil | 71 | | Former Chief Executive Officer and Chairman of the Board, ING Capital, LLC | Finance and Risk (Chair), NGCR | 0 | 2013 |

| Richard J. Osborne | 73 | | Former Chief Financial Officer, Duke Energy Corporation | Audit, Compensation (Chair) | 0 | 2013 |

| Steven G. Osgood | 67 | | Chief Executive Officer, Square Foot Companies, LLC | Audit (Chair), Compensation | 1 | 2015 |

| Kimberly A. Reed | 53 | | Former Chairman of the Board of Directors, President, and Chief Executive Officer, Export-Import Bank of the United States | Audit, Finance and Risk | 2 | 2023 |

(1)Furnished as of March 21, 2024.

| | | | | |

HASI Proxy Statement 2024 | 3 |

Director Nominee Highlights

Our board of directors has a strong mix of desired attributes, including business experience, tenure, age, diversity and independence. Four of ten director nominees have joined our board of directors since 2019, three of whom are independent directors. The following is a snapshot of some key characteristics of our director nominees.

Tenure

FIVE 1-4 YEARS

ONE 5-8 YEARS

FOUR 9+ YEARS

3

Financial Experts

65

Average Age

Qualifications

CEO/SENIOR LEADERSHIP EXPERIENCE

CPA OR FINANCIAL

POWER/UTILITY/NATURAL RESOURCES INDUSTRIES

RISK MANAGEMENT

STRATEGIC PLANNING

CORPORATE GOVERNANCE

TECHNOLOGY

COMMERCIAL LENDING

HUMAN CAPITAL MANAGEMENT

FINANCIAL SERVICES

MERGERS & ACQUISITIONS

Governance Highlights

| | | | | |

| |

Separate Chair and CEO | On March 1, 2023, we separated the roles of chair and chief executive officer |

Sustainability and Impact Governance | Robust oversight structure covering our strategies, activities, and policies, including our Sustainability Investment Policy, Environmental Policies, and Human Rights and Human Capital Management Policies |

Commitment to DEIJA | Women and racially diverse directors constitute half our director nominees and a majority of our independent directors |

| |

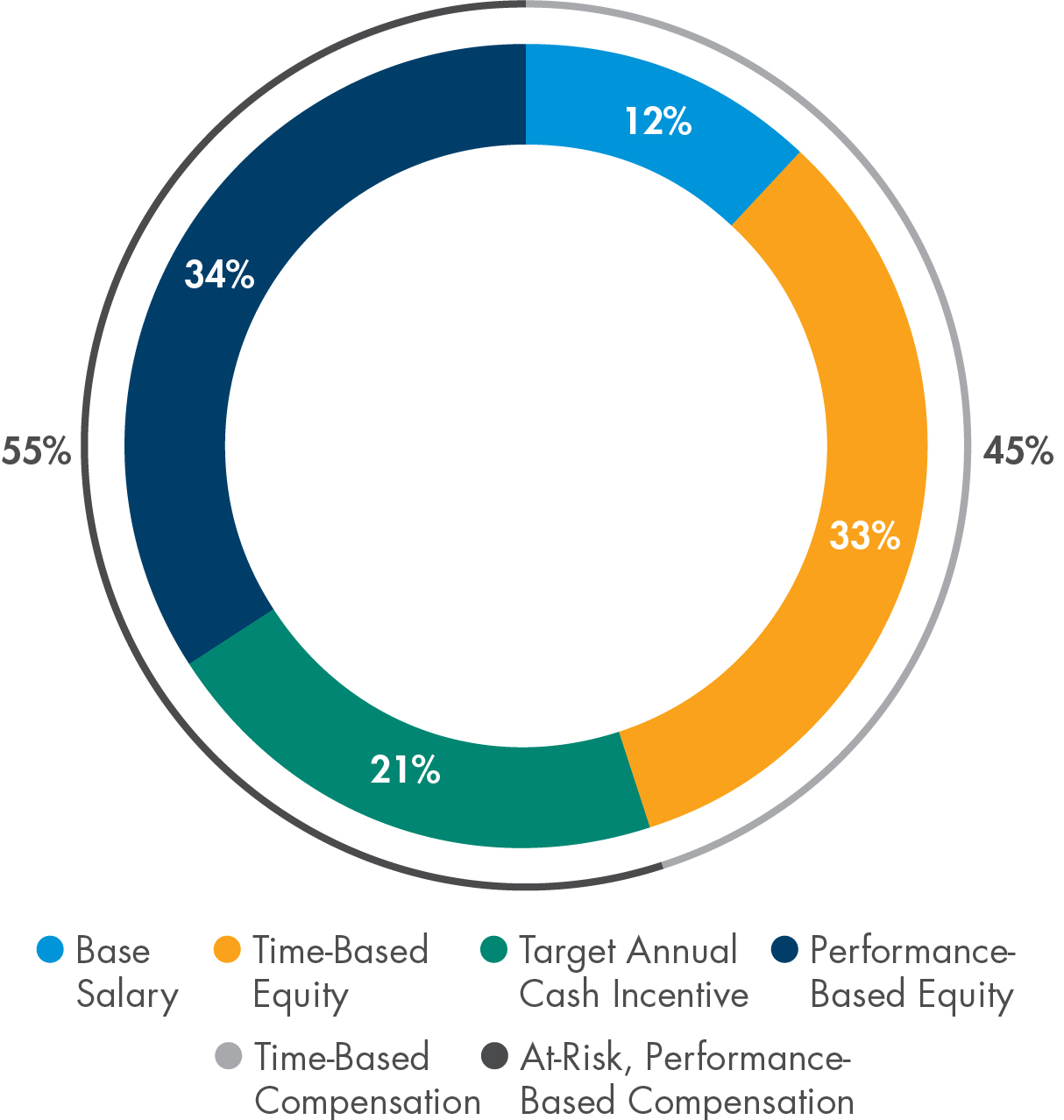

Compensation Highlights

| | | | | |

| |

| Pay for Performance Philosophy | Executive compensation encourages and rewards strong financial and operational performance |

Implicit Link to Sustainability and Impact Performance | Executive compensation is implicitly linked to Sustainability and Impact performance due to our focus on investments in climate solutions, which drive growth in key compensation-linked financial metrics |

CEO Pay Ratio | For 2023, the compensation for our chief executive officer was 34x the compensation of our median employee |

| |

| | | | | |

4 | HASI Proxy Statement 2024 |

Proxy Statement for Annual Meeting of Stockholders to be Held on June 6, 2024

This proxy statement is being furnished to stockholders in connection with the solicitation of proxies by and on behalf of the board of directors of Hannon Armstrong Sustainable Infrastructure Capital, Inc., a Maryland corporation (the “Company,” “we,” “our” or “us”), for use at the Company’s 2024 annual meeting of stockholders (the “Annual

Meeting”) to be held via a live webcast at www.virtualshareholdermeeting.com/HASI2024 (password: enter your 16-digit control number) on June 6, 2024, at 9:30 am, Eastern Time, or at any postponements or adjournments thereof.

Proposal No. 1

Election of Directors

Our board of directors is currently comprised of eleven directors: Jeffrey W. Eckel, Jeffrey A. Lipson, Lizabeth A. Ardisana, Clarence D. Armbrister, Teresa M. Brenner, Michael T. Eckhart, Nancy C. Floyd, Charles M. O’Neil, Richard J. Osborne, Steven G. Osgood and Kimberly A. Reed. In accordance with our charter (the “Charter”) and Amended and Restated Bylaws (the “Bylaws”), each director was elected at the 2023 Annual Meeting to hold office until the next annual meeting of stockholders and until his or her successor has been duly elected and qualifies, or until the director’s earlier resignation, death or removal. See “—Identification of Director Candidates” and “—Vacancies.”

Upon the recommendation of the Nominating, Governance and Corporate Responsibility Committee of our board of directors (the “NGCR Committee”), our board of directors has nominated ten of our current directors to stand for election as directors at the Annual Meeting — Jeffrey W. Eckel, Jeffrey A. Lipson, Lizabeth A. Ardisana, Clarence D. Armbrister, Teresa M. Brenner, Nancy C. Floyd, Charles M. O’Neil, Richard J. Osborne, Steven G. Osgood and Kimberly A. Reed (the “director nominees”). The director nominees were selected based on the qualifications and experience described in the biographical information below. Having reached the target retirement established by

our board of directors, Mr. Eckhart, whose term expires at the Annual Meeting, has not been renominated for election. Effective upon the expiration of Mr. Eckhart’s term, the size of our board of directors will be reduced from eleven to ten directors.

The procedures and considerations of the NGCR Committee in recommending qualified director nominees are described below under “—Identification of Director Candidates.” Each director nominee’s term will run until the next annual meeting of stockholders following the Annual Meeting and until their respective successors are duly elected and qualify.

It is intended that the shares of our common stock, par value $0.01 per share (the “Common Stock”) represented by properly submitted proxies will be voted by the persons named therein as proxy holders FOR the election of each of the director nominees listed in this Proxy statement unless otherwise instructed. See “—Voting on Director Nominees” below for more information.

| | | | | |

| |

| Our board of directors recommends a vote FOR the election of each of the director nominees. |

| |

| | | | | |

HASI Proxy Statement 2024 | 5 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

INFORMATION ABOUT THE DIRECTOR NOMINEES

Information About the Director Nominees1

| | | | | |

| JEFFREY W. ECKEL |

| |

Age 65 Executive Chair – Board of Directors since 2023 | Mr. Eckel has served as executive chair from March 2023. Mr. Eckel served as chief executive officer, president and chair from 2013 through February 2023, and was with the predecessor of our Company as president and chief executive officer since 2000 and prior to that from 1985 to 1989 as a senior vice president. Mr. Eckel serves on the board of trustees of The Nature Conservancy of Maryland and DC. Mr. Eckel was appointed by the governor of Maryland to the board of the Maryland Clean Energy Center in 2011 where Mr. Eckel served until 2016 while also serving as its chairman from 2012 to 2014. Mr. Eckel has over 35 years of experience in financing, owning and operating infrastructure and energy assets. Mr. Eckel received a Bachelor of Arts degree from Miami University in 1980 and a Master of Public Administration degree from Syracuse University, Maxwell School of Citizenship and Public Affairs, in 1981. We believe Mr. Eckel’s extensive experience in managing companies operating in the energy sector and expertise in energy investments make him qualified to serve as executive chair. |

| |

| | | | | |

| JEFFREY A. LIPSON | |

| |

Age 56 Director since 2023 Chief Executive Officer and President | Mr. Lipson has served as chief executive officer and president from March 2023. He served as executive vice president and our chief operating officer from 2021 to February 2023, and as our chief financial officer from 2019 to February 2023. Previously, Mr. Lipson was president and chief executive officer and director of Congressional Bancshares and its subsidiary Congressional Bank (now Forbright Bank). Mr. Lipson has also been a senior vice president and the treasurer of CapitalSource Inc. and its subsidiary CapitalSource Bank and a senior vice president, Corporate Treasury, at Bank of America and its predecessor FleetBoston Financial. Mr. Lipson received a Bachelor of Science degree in Economics from Pennsylvania State University in 1989 and a Master of Business Administration in Finance from New York University’s Leonard N. Stern School of Business in 1993. We believe Mr. Lipson’s significant prior experience as a chief executive officer and his extensive financial expertise make him qualified to serve as president and chief executive officer and as a member of our board of directors. |

| |

| | | | | |

| TERESA M. BRENNER | |

| |

Age 60 Independent Director since 2016 Lead Independent Director since 2019 Committee: •NGCR Committee (Chair) •Compensation Committee | Ms. Brenner retired from Bank of America Corporation in 2012, where she served in a variety of roles for approximately 20 years, including most recently as a managing director and associate general counsel. Ms. Brenner served on the board of directors of Residential Capital, LLC from March 2013 to December 2013 during its restructuring and through the confirmation of its bankruptcy proceeding. Ms. Brenner is a member of the National Association of Corporate Directors, the Society of Corporate Governance, and the American Corporate Counsel Association, and is a member in good standing of the North Carolina State Bar. Ms. Brenner has also held a variety of philanthropic and civic roles, including serving as president of Temple Israel and chairperson of Right Moves for Youth. Ms. Brenner received a Bachelor of Arts degree magna cum laude and with honors in history from Alma College in 1984 where she was inducted into Phi Beta Kappa and a Juris Doctorate cum laude from Wake Forest University School of Law in 1987 where she was a Carswell Scholar and an editor of its Law Review. We believe Ms. Brenner’s extensive experience in corporate governance and corporate strategy, law and compliance, and finance and capital markets gives her valuable insight and enables her to make significant contributions as a member of our board of directors. |

| |

(1)Furnished as of March 21, 2024.

| | | | | |

6 | HASI Proxy Statement 2024 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

INFORMATION ABOUT THE DIRECTOR NOMINEES

| | | | | |

| LIZABETH A. ARDISANA | |

| |

Age 71 Independent Director since 2022 Committee: •Audit Committee •Compensation Committee | Ms. Ardisana is chief executive officer and the principal owner of ASG Renaissance LLC, which she founded in 1987. ASG Renaissance is a technical and communication services firm with more than three decades of experience providing services to a wide range of clients in the automotive, environmental, defense, construction, healthcare, banking and education sectors. She is also chief executive officer of Performance Driven Workforce LLC, a scheduling and staffing firm that was founded in 2015 and has since expanded into five states. Prior to founding ASG Renaissance LLC, Ms. Ardisana worked at Ford Motor Company for 14 years, holding various management positions in vehicle development, product planning and marketing. As a Hispanic and female business owner, Ms. Ardisana is an active business and civic leader in Michigan. She has served on the boards of publicly held Clean Energy Fuels Corp. (Nasdaq: CLNE) since 2019 and Huntington Bancshares Inc. (Nasdaq: HBAN) since 2016. She also serves on the board of the privately held U.S. Sugar Corporation. She was a member of the board of Citizens Republic Bancorp, Inc. from 2004 to 2013, and a member of the board of FirstMerit Corporation from 2013 to 2016. She has held numerous leadership positions in a variety of nonprofit organizations, including The Skillman Foundation, Charles Stewart Mott Foundation, Kettering University, Metropolitan Affairs Coalition, Focus: HOPE, and NextEnergy. Ms. Ardisana was appointed by the governor of Michigan to the executive board of the Michigan Economic Development Corporation and chairs its finance committee. She is the vice chair of the board of Wayne Health, where she serves on the audit committee and compensation committee. Ms. Ardisana holds a Bachelor of Science degree in mathematics and computer science from the University of Texas, a Master of Science degree in mechanical engineering from the University of Michigan, and a Master of Business Administration degree from the University of Detroit. We believe Ms. Ardisana’s considerable experience and relationships in the automotive and environmental industries, as well as skills acquired through serving as a chief executive officer and as a member of multiple public and private company boards, give her valuable insights and enable her to make significant contributions as a member of the Board. |

| |

| | | | | |

| CLARENCE D. ARMBRISTER | |

| |

Age 66 Independent Director since 2021 Committee: •Finance and Risk Committee •NGCR Committee | Mr. Armbrister served as president of Johnson C. Smith University from January 2018 through June 2023. Previously, Mr. Armbrister served as president of Girard College from 2012 to 2017. Mr. Armbrister has served as chair of the audit committee and a member of the compensation committee of Health Partners Plans Inc. since 2016. From 2008 to 2011, Mr. Armbrister served as chief of staff to the former Mayor of Philadelphia, Michael A. Nutter. Mr. Armbrister also served as senior vice president for administration and subsequently executive vice president and chief operating officer of Temple University from 2003 to 2007. Prior to that Mr. Armbrister served as vice president and director in the Municipal Securities Group and in other positions at PaineWebber & Co. (subsequently UBS PaineWebber Incorporated) from 1999 to 2003 and also served as an adjunct faculty member of the Beasley School of Law at Temple University from 1997 to 1998. From 1996 to 1998, Mr. Armbrister served as managing director of the Philadelphia School District and prior to that, in 1994, he was appointed Philadelphia City treasurer. From 1982 to 1994, Mr. Armbrister was an associate and then partner at Saul, Ewing, Remick & Saul (currently known as Saul Ewing Arnstein & Lehr LLP). Mr. Armbrister also serves on the boards of various organizations, including the board of directors for Health Partners Plan and the board of trustees of Devereux Advanced Behavioral Health, of which he was elected chair in November 2023. Mr. Armbrister is also a former member of the board of directors of the Charlotte Regional Business Alliance, the board of directors of the National Adoption Center and the Community College of Philadelphia’s board of trustees. Mr. Armbrister received a Bachelor of Arts degree in Political Science and Economics from the University of Pennsylvania in 1979 and a Juris Doctor degree from the University of Michigan Law School in 1982. We believe Mr. Armbrister’s over 35 years of experience in education, law, government and finance gives him valuable insight and enables him to make significant contributions as a member of our board of directors. |

| |

| | | | | |

| NANCY C. FLOYD | |

| |

Age 69 Independent Director since 2021 Committee: •Audit Committee •Finance and Risk Committee | Ms. Floyd served as a managing director of Nth Power LLC, a venture capital firm she founded that specialized in clean energy technology, from 1993 to 2022. From 1989 to 1993, Ms. Floyd joined and started the technology practice for the utility consulting firm, Barakat and Chamberlain. From 1985 to 1988, Ms. Floyd was on the founding team and worked at PacTel Spectrum Services, a provider of network management services that was sold to IBM. In 1982, Ms. Floyd founded and served as chief executive officer of NFC Energy Corporation, one of the first wind development companies in the United States, which she successfully sold. From 1977 to 1980, Ms. Floyd served as director of special projects of the Vermont Public Service Board (currently known as Vermont Public Utility Commission). Ms. Floyd has also served on the boards of 14 private, high growth, clean tech companies and was chair of the board for 4 of them. From 2020 to 2023, Ms. Floyd was a board member, chair of the audit committee and member of the compensation committee and nominating and corporate governance committee of Beam Global (Nasdaq: BEEM, BEEMW). She also served as a member of the board and chair of the audit committee of AltaGas Services and AltaGas Power Holdings (U.S.) Inc. (TSX: ALA) from 2018 to 2019, and board member of WGL Holdings, Inc. and Washington Gas (NYSE: WGL) from 2011 to 2018, where she sat on the audit committee and governance committee. Also, Ms. Floyd has served as fund advisor to Activate Capital from 2018 to 2021 and on the investment committee for The Christensen Fund from 2017 to 2021. Ms. Floyd received a Bachelor of Arts degree in Government from Franklin & Marshall College in 1976 and a Master of Arts degree in Political Science from Rutgers University in 1977. We believe Ms. Floyd’s extensive experience in clean energy technology and utilities makes her qualified to serve as a member of our board of directors. |

| |

| | | | | |

HASI Proxy Statement 2024 | 7 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

INFORMATION ABOUT THE DIRECTOR NOMINEES

| | | | | |

| CHARLES M. O’NEIL | |

| |

Age 71 Independent Director since 2013 Committee: •Finance and Risk Committee (Chair) •NGCR Committee | Mr. O’Neil retired from ING Capital, LLC, at the end of 2015, where he served in a variety of executive and management roles for over 20 years, including as president, chief executive officer and chairman of the board of ING Capital, LLC and head of Structured Finance, Americas, the largest operating unit of ING Capital. Mr. O’Neil received a Bachelor of Science degree in Finance from The Pennsylvania State University in 1974 and a Master in Business Administration degree in International Finance from Fordham University in 1978. We believe Mr. O’Neil’s experience of over 35 years in structured and project finance focusing on energy related projects, combined with his senior management role with a large international bank’s wholesale banking activities in the Americas, makes him qualified to serve as a member of our board of directors. |

| |

| | | | | |

| RICHARD J. OSBORNE | |

| |

Age 73 Independent Director since 2013 Committee: •Compensation Committee (Chair) •Audit Committee | Mr. Osborne retired from Duke Energy Corporation in 2006, having served in a variety of executive roles including chief financial officer, chief risk officer, treasurer and group vice president for Public & Regulatory Affairs during his 31 years with the organization. Mr. Osborne also served as a director of Duke Energy Field Services, a joint venture between Duke Energy Corporation and ConocoPhillips, and as a director of TEPPCO Partners, LP, a master limited partnership managing mid-stream energy assets. He also chaired the Finance Divisions of the Southeastern Electric Exchange and Edison Electric Institute, and was a founding board member of the Committee of Chief Risk Officers. Subsequent to leaving Duke Energy, Mr. Osborne executed consulting assignments for clients in, or serving, the energy industry. Mr. Osborne presently serves on the boards of Chautauqua Institution and the Chautauqua Foundation, and is a trustee and immediate past chair of the board of the Penland School of Craft. Mr. Osborne received a Bachelor of Arts degree in History and Economics from Tufts University in 1973 and a Master of Business Administration from the University of North Carolina at Chapel Hill in 1975. We believe that Mr. Osborne’s over 35 years of experience in energy sector finance makes him qualified to serve as a member of our board of directors. |

| |

| | | | | |

| STEVEN G. OSGOOD | |

| |

Age 67 Independent Director since 2015 Committee: •Audit Committee (Chair) •Compensation Committee | Mr. Osgood has served as the chief executive officer of Square Foot Companies, LLC, a Cleveland, Ohio-based private real estate company focused on self-storage and single-tenant properties, since 2008. Mr. Osgood is also a trustee for National Storage Affiliates Trust, a real estate investment trust (“REIT”) focused on the ownership of self-storage properties, since its public offering in April 2015. Mr. Osgood serves as chair of the finance committee for the company and on its audit committee. Prior to his current position, Mr. Osgood served as president and chief financial officer of U-Store-It Trust (now named CubeSmart), a self-storage REIT from the company’s initial public offering in 2004 to 2006. He also served as chief financial officer of several other REITs. Mr. Osgood is a former Certified Public Accountant. He graduated from Miami University with a Bachelor of Science degree in 1978 and graduated from the University of San Diego with a Masters in Business Administration in 1987. We believe that Mr. Osgood’s experience as a chief executive officer and over 20 years of experience in corporate finance make him qualified to serve as a member of our board of directors. |

| |

| | | | | |

8 | HASI Proxy Statement 2024 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

INFORMATION ABOUT THE DIRECTOR NOMINEES

| | | | | |

| KIMBERLY A. REED | |

| |

Age 53 Independent Director since 2023 Committee: •Audit Committee •Finance and Risk Committee | Ms. Reed has served as an external director of Takeda Pharmaceutical Company Limited since June 2022 and an independent director of Momentus Inc. since August 2021. From May 2019 to January 2021— after being confirmed by the U.S. Senate on a strong bipartisan basis — Ms. Reed served as the first woman chairman of the board of directors, president and chief executive officer of the Export-Import Bank of the United States (EXIM), the nation’s official $135 billion export credit agency, where she worked to help U.S. companies, including those focused on clean and renewable energy, succeed in the competitive global marketplace. She previously served as president of the International Food Information Council Foundation where she focused on agriculture, nutrition, health, and sustainability issues; senior advisor to U.S. Treasury Secretaries Henry Paulson and John Snow; chief executive officers of the Community Development Financial Institutions Fund (CDFI Fund); and counsel to three committees of the U.S. Congress where she conducted oversight and investigations. Ms. Reed also currently serves on the American Swiss Foundation board of directors, and is a Distinguished Fellow with the Council on Competitiveness and the Atlantic Council Freedom and Prosperity Center. Additionally, she is involved with a variety of initiatives, including the Hudson Institute’s Alexander Hamilton Commission on Securing America’s National Security Innovation Base, Krach Institute for Tech Diplomacy at Purdue Advisory Council and Indiana University School of Public Health-Bloomington Dean’s Alliance. Recognized as one of the “100 Women Leaders in STEM,” she received the U.S. Department of Defense’s highest civilian award — the Medal for Distinguished Public Service — and is a Council on Foreign Relations life member and a National Association of Corporate Directors (NACD) Certified Director. She holds a Juris Doctor degree from West Virginia University College of Law and a Bachelor of Science in Biology and a Bachelor of Arts in Government from West Virginia Wesleyan College. We believe Ms. Reed’s experience in government and international finance, as well as her service on U.S. and non-U.S. public company boards, make her qualified to serve as a member of our board of directors. |

| |

| | | | | |

HASI Proxy Statement 2024 | 9 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

SKILLS, EXPERTISE AND ATTRIBUTES

Skills, Expertise and Attributes

The NGCR Committee and our board of directors consider a broad range of factors when selecting nominees. We seek highly qualified director candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. We believe that, as a group, the director nominees bring a diverse range of perspectives that contribute to the effectiveness of our board of directors as a whole.

The table below represents some of the key skills and attributes that our board of directors has identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy, and identifies the director nominees that have that skill or attribute. This director skills matrix is not intended to be an exhaustive list of each of our director nominees’ skills and attributes or contributions to our board of directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SKILLS & EXPERTISE |

| Experience | Eckel | Brenner | Ardisana | Armbrister | Floyd | Lipson | O’Neil | Osborne | Osgood | Reed |

| Risk Management | | | | | | | | | | |

| Capital Markets | | | | | | | | | | |

| CPA or Financial | | | | | | | | | | |

| Power / Utility / Natural Resources Industries | | | | | | | | | | |

| Financial Services | | | | | | | | | | |

| Strategic Planning | | | | | | | | | | |

| Technology | | | | | | | | | | |

| CEO/Senior Leadership Experience | | | | | | | | | | |

| Mergers & Acquisitions | | | | | | | | | | |

| Corporate Governance | | | | | | | | | | |

| Human Capital Management | | | | | | | | | | |

| Commercial Lending | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BACKGROUND |

| Years on Board | 11 | 8 | 1 | 3 | 3 | 1 | 11 | 11 | 9 | 1 |

| Age | 65 | 60 | 73 | 66 | 69 | 56 | 71 | 73 | 67 | 53 |

Gender Identification | M | F | F | M | F | M | M | M | M | F |

| African American / Black | | | | | | | | | | |

Asian / South Asian | | | | | | | | | | |

| White / Caucasian | | | | | | | | | | |

| Hispanic / Latino | | | | | | | | | | |

Indigenous | | | | | | | | | | |

LGBTQ+ | | | | | | | | | | |

Veteran | | | | | | | | | | |

Disabled | | | | | | | | | | |

| | | | | |

10 | HASI Proxy Statement 2024 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

IDENTIFICATION OF DIRECTOR CANDIDATES

Identification of Director Candidates

In accordance with our Corporate Governance Guidelines (the “Guidelines”) and its written charter, the NGCR Committee is responsible for identifying director candidates for our board of directors and for recommending director candidates to our board of directors for consideration as nominees to stand for election at our annual meetings of stockholders. Director candidates are recommended for nomination for election as directors in accordance with the procedures set forth in the written charter of the NGCR Committee.

As noted above, we seek highly qualified director candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. The NGCR Committee periodically reviews the appropriate skills and characteristics required of our directors in the context of the current composition of our board of directors, our operating requirements and the long-term interests of our stockholders. In accordance with the Guidelines, directors should possess the highest personal and professional ethics, integrity and values, exercise good business judgment, be committed to representing the long-term interests of the Company and our stockholders and have an inquisitive and objective perspective, practical wisdom and mature judgment. The NGCR Committee reviews director candidates with the objective of assembling a slate of directors that can best fulfill and promote our goals, taking into consideration personal factors and professional characteristics of each potential candidate, and recommends director candidates based upon contributions they can make to our board of directors and management and their ability to represent our long-term interests and those of our stockholders and other stakeholders.

The NGCR Committee evaluates the skill sets required for service on our board of directors and has developed a list of potential director candidates. If it is determined there is the need for additional or replacement board members, the NGCR Committee will assess potential director candidates included on the list as well as other appropriate potential director candidates based upon information it receives regarding such potential candidates or otherwise possesses, which assessment may be supplemented by additional inquiries. In conducting this assessment, the NGCR Committee considers knowledge, experience, skills, diversity and such other factors as it deems appropriate in light of our current needs and those of our board of directors. The NGCR Committee may seek input on director candidates from other directors. The NGCR Committee does not solicit director nominations, but it may consider recommendations by stockholders using the same criteria that it uses to evaluate other nominees. The NGCR Committee may, in its sole discretion, engage one or more search firms or other consultants, experts or professionals to assist in, among other things, identifying director candidates or gathering information regarding the background and experience of director candidates. The NGCR Committee will have sole authority to approve any fees or terms of retention relating to these services.

Our stockholders of record who comply with the advanced notice procedures set forth in our current Bylaws and outlined under the “Submission of Stockholder Proposals” section of this proxy statement may nominate candidates for election as directors. See “Submission of Stockholder Proposals” for information regarding providing timely notice of stockholder proposals under our Bylaws and the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”).

Majority Vote Policy

The Guidelines provide for a majority vote policy for the election of directors. Pursuant to this policy, in any uncontested election of directors, any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation to our board of directors following certification of the stockholder vote. The NGCR Committee shall promptly consider the resignation and make a recommendation to our board of directors with respect to the tendered resignation. In considering whether to accept or reject the tendered resignation, the NGCR Committee shall consider all factors it deems relevant, which may include the stated reasons, if any, why stockholders

withheld votes from the director, any alternatives for curing the underlying cause of the withheld votes, the length of service and qualifications of the director, the director’s past and expected future contributions to the Company, the composition of our board of directors, and such other information and factors as members of the NGCR Committee shall determine are relevant. Our board of directors will act on the NGCR Committee’s recommendation no later than 90 days after the certification of the stockholder vote. Any director who tenders his or her resignation to our board of directors will not participate in the NGCR Committee’s consideration or board action regarding whether to accept such tendered resignation.

| | | | | |

HASI Proxy Statement 2024 | 11 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

VACANCIES

We will promptly disclose our board of director’s decision whether to accept the resignation as tendered (providing a full explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the

tendered resignation) in a press release, a filing with the SEC or in another broadly disseminated means of communication.

Vacancies

In accordance with our Charter and Bylaws, any vacancies occurring on our board of directors, including vacancies occurring as a result of the death, resignation, or removal of a director, or due to an increase in the size of our board of directors, may be filled only by the affirmative vote of a majority of the directors remaining in office, even if the

remaining directors do not constitute a quorum, and any director elected to fill a vacancy will serve for the remainder of the full term of the directorship in which the vacancy occurred and until a successor is duly elected and qualifies.

Voting on Director Nominees

A plurality of all the votes cast on the proposal at the Annual Meeting at which a quorum is present is necessary to elect a director. Proxies solicited by our board of directors will be voted FOR each director nominee unless otherwise instructed. Because directors are elected by a plurality of the votes cast in the election of directors, and no additional nominations may be properly presented at the Annual Meeting, ‘withhold’ votes will have no effect on the election of directors. However, any director nominee who receives a greater number of ‘withhold’ votes from his or her election than ‘for’ is required to tender his or her resignation as described above under “Majority Vote Policy." Abstentions and broker non-votes are not votes and will have no effect on the result of the vote,

although they will be considered present for the purpose of determining the presence of a quorum. If the candidacy of any director nominee should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidates (if any) as shall be nominated by our board of directors. Our board of directors has no reason to believe that any nominee will be unable or unwilling to serve as a director.

| | | | | |

12 | HASI Proxy Statement 2024 |

Board and Corporate Governance Structure

Corporate Governance Philosophy

Our corporate governance philosophy is based on maintaining a close alignment of our interests with those of our stockholders. Notable features of our current corporate governance structure include the following:

| | | | | | | | | | | |

| Our Board of Directors | Our Policies | Our Charter and Bylaws | Our Stockholder Engagement |

•We separated the roles of chair and chief executive officer. •We have a majority vote policy for the election of directors. •Our board of directors is not staggered. •Nine of our eleven current directors are independent. •We have a Lead Independent Director. •Three directors qualify as an “audit committee financial experts” as defined by the SEC. •Four directors, including our Lead Independent Director, are women, constituting 36% of our board of directors. •Women and racially diverse directors constitute a majority of our nine independent directors. •We have established a target retirement age of 75 for our directors. •Our NGCR Committee oversees and directs our environmental, social and governance (“Sustainability and Impact”) strategies, activities, policies and communications. | •Our board members and NEOs (as defined herein) are required to maintain certain levels of stock ownership in our company ranging between three and six times their base salary or retainer, depending on position. •Our Statement of Corporate Policy Regarding Equity Transactions prohibits our directors and officers from hedging our equity securities, holding such securities in a margin account or pledging such securities as collateral for a loan. •Our Clawback Policy provides for the possible recoupment of performance or incentive-based compensation in the event of an accounting restatement due to material noncompliance by us with any financial reporting requirements under the securities laws (other than due to a change in applicable accounting methods, rules or interpretations). | •We have opted out of the control share acquisition statute in the Maryland General Corporation Law (the “MGCL”). •We have exempted from the business combination statute in the MGCL transactions that are approved by our board of directors (including a majority of our directors who are not affiliates or associates of the acquiring person). •Our stockholders have the concurrent right to amend our Bylaws. | •We have an active stockholder outreach program, including annually providing our stockholders the opportunity to vote on an advisory basis on the compensation of NEOs. |

In order to foster the highest standards of ethics and conduct in all business relationships, we have adopted a Code of Business Conduct and Ethics policy (the “Code of Conduct”). The Code of Conduct, which covers a wide range of business practices and procedures, applies to our officers, directors, employees, agents, representatives, and consultants. In addition, our whistleblowing policy (the

“Whistleblower Policy”) sets forth procedures by which any Covered Persons (as defined in the Whistleblower Policy) may report, on a confidential basis, concerns relating to any questionable or unethical accounting, internal accounting controls or auditing matters, as well as any potential Code of Conduct or ethics violations. We review these policies on a periodic basis with our employees.

| | | | | |

HASI Proxy Statement 2024 | 13 |

BOARD AND CORPORATE GOVERNANCE STRUCTURE

OUR BOARD OF DIRECTORS

Our Board of Directors

Our board of directors is responsible for overseeing our affairs, and it conducts its business through meetings and actions taken by written consent in lieu of meetings. Pursuant to our Charter and Bylaws and the MGCL, our business and affairs are managed under the direction of our board of directors. Our board of directors has the responsibility for establishing broad corporate policies and for our overall performance and direction, but is not involved in our day-to-day operations, which are managed by our senior management team. Members of our board of

directors keep informed of our business by participating in meetings of our board of directors and its committees, by reviewing analyses, reports and other materials provided to them, and through discussions with our president and chief executive officer and other executive officers and other employees of the Company.

Our board of directors intends to hold at least four regularly scheduled meetings per year, generally one per calendar quarter, and additional special meetings as necessary.

Board of Directors Leadership Structure

Our board of directors has the flexibility to decide when the positions of chair and chief executive officer should be held by one person or separated, and whether an executive or an independent director should be chair. This allows our board of directors to choose the leadership structure that it believes will best serve the interests of our stockholders at any particular time. Currently, Mr. Eckel serves as the executive chair, and Mr. Lipson serves as our chief executive officer. In addition, our board of directors has an active Lead Independent Director, Teresa M. Brenner. Our board of directors believes that this leadership structure is best for the Company and its stockholders at this time.

Our board of directors considered the actual board relationships and determined that there is actual and effective independent oversight of management by our supermajority independent board led by Ms. Brenner in her capacity as our Lead Independent Director. Ms. Brenner has served as our Lead Independent Director since 2019. Our board of directors believes that this board leadership structure, when combined with the functioning of the independent director component of our board of directors and our overall corporate governance structure, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs.

| | | | | |

ROLE OF THE LEAD INDEPENDENT DIRECTOR |

| |

TERESA M. BRENNER | •Collaborate with the executive chair, chief executive officer and secretary to schedule meetings of our board of directors and to set meeting agenda •Ensure that matters of concern or interest to the independent directors are appropriately scheduled for discussion at board of directors meetings •Chair meetings in the absence of the executive chair •Organize and preside over meetings and executive sessions of the independent directors •Serve as the principal liaison between the independent directors and the executive chair or chief executive officer on matters where either person may be conflicted •Together with the full board of directors, evaluate the performances of the chief executive officer and executive chair and meet with each of the chief executive officer and executive chair to discuss such evaluations •Authorize the retention of outside advisors and consultants who report directly to our board of directors •Meet regularly with the executive chair as well as each director •Along with management, periodically meet with institutional and other investors |

| |

| | | | | |

14 | HASI Proxy Statement 2024 |

BOARD AND CORPORATE GOVERNANCE STRUCTURE

OUR BOARD OF DIRECTORS

Director Independence, Executive Sessions and Independent Oversight

The Guidelines provide that a majority of the directors serving on our board of directors must be independent as required by NYSE listing standards. In addition, as permitted under the MGCL, our board of directors has adopted certain independence standards (the “Independence Standards”) to assist it in making determinations with respect to the independence of directors. The Independence Standards are available for viewing on our website at www.hasi.com. Based upon its review of all relevant facts and circumstances, our board of directors has affirmatively determined that nine of our eleven current directors—Lizabeth Ardisana, Clarence Armbrister, Teresa Brenner, Michael Eckhart, Nancy Floyd, Charles O’Neil, Richard Osborne, Steven Osgood and Kimberly Reed—qualify as independent directors under the NYSE listing standards and the Independence Standards.

There is no familial relationship, as defined under the SEC regulations, among any of our directors or executive officers.

The independent directors serving on our board of directors meet in executive sessions at least four times per year at regularly scheduled meetings of our board of directors and are active in the oversight of the Company. These executive sessions of our board of directors are presided over by our Lead Independent Director, Ms. Brenner. The independent directors oversee such critical matters as the integrity of our financial statements, the evaluation and compensation of executive officers and the selection and evaluation of directors. Each independent director has the ability to add items to the agenda of our board of directors meetings or raise subjects for discussion that are not on the agenda for that meeting.

| | | | | |

HASI Proxy Statement 2024 | 15 |

BOARD AND CORPORATE GOVERNANCE STRUCTURE

OUR BOARD OF DIRECTORS

Committees

Our board of directors has four standing committees: the Audit Committee, the Compensation Committee, the Nominating, Governance and Corporate Responsibility Committee and the Finance and Risk Committee. Our committees are comprised solely of independent directors.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | Primary Responsibilities •Engaging our independent registered public accounting firm. •Reviewing with the independent registered public accounting firm the plans and results of the audit engagement. •Approving professional services provided by the independent registered public accounting firm. •Reviewing the independence of the independent registered public accounting firm. •Considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. •Overseeing: •our and our subsidiaries’ corporate accounting and reporting practices, •the quality and integrity of our consolidated financial statements, •our compliance with applicable legal and regulatory requirements, •the performance, qualifications and independence of our external auditors, and •the staffing, scope of work, performance, budget, responsibilities and qualifications of our internal audit function, including the engagement of outside advisors to assist our internal audit function. •Reviewing our policies with respect to risk assessment and risk management, which responsibility is shared with the Finance and Risk Committee. •Reviewing, with management and external auditors, our unaudited interim and audited annual financial statements as well as approving the filing of our financial statements. •Meeting with officers responsible for certifying our annual report on Form 10-K or any quarterly report on Form 10-Q prior to any such certification and reviewing with such officers any disclosures related to any significant deficiencies or material weaknesses in the design or operation of internal controls. •Periodically discussing with our external auditors such auditors’ judgments about the quality, not just the acceptability, of our accounting principles as applied in our consolidated financial statements. The specific responsibilities of the Audit Committee are set forth in its written charter, which is available for viewing on our website at www.hasi.com. Independence Our board of directors has determined that all of the members of the Audit Committee are independent as required by the NYSE listing standards, SEC rules governing the qualifications of Audit Committee members, the Guidelines, the Independence Standards and the written charter of the Audit Committee. Financial Expertise and Literacy Our board of directors has also determined, based upon its qualitative assessment of their relevant levels of knowledge and business experience, that Mr. Osgood, Ms. Floyd and Mr. Osborne each qualify as an “audit committee financial expert” for purposes of, and as defined by, the SEC rules and each has the requisite accounting or related financial management expertise required by NYSE listing standards. In addition, our board of directors has determined that all of the members of the Audit Committee are financially literate as required by the NYSE listing standards. Report The Audit Committee Report is set forth beginning on page 38 of this proxy statement. | |

| Audit Committee Current Members Steven G. Osgood (Chair) Lizabeth A. Ardisana Nancy C. Floyd Richard J. Osborne Kimberly A. Reed | | |

| | | | |

| | | | | |

16 | HASI Proxy Statement 2024 |

BOARD AND CORPORATE GOVERNANCE STRUCTURE

OUR BOARD OF DIRECTORS

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | Primary Responsibilities •Overseeing the approval, administration and evaluation of our compensation plans, policies and programs. •Reviewing the compensation of our directors and executive officers. •Overseeing regulatory compliance with respect to compensation matters. •Reviewing and approving and, when appropriate, recommending to our board of directors for approval, any employment agreements and any severance arrangements or plans for our executive officers. •Evaluating its relationship with any compensation consultant for any conflicts of interest and assessing the independence of any compensation consultant, legal counsel or other advisors. The specific responsibilities of the Compensation Committee are set forth in its written charter, which is available for viewing on our website at www.hasi.com. In February 2024, our board of directors amended the Compensation Committee charter to (1) clarify the Compensation Committee’s role in coordinating with the NGCR Committee to assist our board of directors in its oversight of the Company’s practices as they relate to the Company’s human capital management with respect to the Company’s compensation plans (e.g., retention, talent management, and pay equity practices) and (2) delegate to the Compensation Committee the responsibility to adopt, amend and oversee the Company’s policies regarding the recoupment of compensation paid to executives or employees, if and as the Compensation Committee deems appropriate or as required by law or the rules of the New York Stock Exchange. Further, the amendments clarified that it is not the duty of the Compensation Committee to administer the Company’s compensation or human resources plans, policies or programs, the administration of which is the responsibility of our management. Independence Our board of directors has determined that each of the members of the Compensation Committee is independent as required by the NYSE listing standards, SEC rules, the Guidelines, the Independence Standards and the written charter of the Compensation Committee. Compensation Consultant Since 2018, the Compensation Committee has engaged Pay Governance LLC (“Pay Governance”), a compensation consulting firm, to assist the Compensation Committee on the setting of certain annual bonus targets for our NEOs. In July 2019, the Compensation Committee also engaged Pay Governance to provide analysis and recommendations regarding (1) base salaries, annual bonuses and long-term incentive compensation for our executive management team, and (2) the director compensation program for non-employee members of our board of directors. Pay Governance was also engaged in March 2021 to evaluate the benefits of adopting a Diversity, Equity, Inclusion, Justice and Anti-Racism (“DEIJA”) policy as well as proposing various performance standards related to the promotion of such policy as it relates to the composition of the members of our board of directors and leadership team against which annual CEO compensation would be evaluated by our board of directors. Pay Governance reports directly to the Compensation Committee and the Compensation Committee has determined that Pay Governance is independent pursuant to the Company’s Compensation Committee charter. Compensation Committee Interlocks and Insider Participation The Compensation Committee is comprised solely of independent directors. No member of the compensation committee is a current or former officer or employee of ours or any of our subsidiaries. Other than Mr. Eckel and Mr. Lipson’s service both as executive officers and as members of our board of directors, none of our executive officers serves as a member of the board of directors or compensation committee of any company that has one or more of its executive officers serving as a member of our board of directors or compensation committee. Report The Compensation Committee Report is set forth beginning on page 58 of this Proxy Statement. | |

| Compensation Committee Current Members Richard J. Osborne (Chair) Lizabeth A. Ardisana Teresa M. Brenner Steven G. Osgood | | |

| | | | |

| | | | | |

HASI Proxy Statement 2024 | 17 |

BOARD AND CORPORATE GOVERNANCE STRUCTURE

OUR BOARD OF DIRECTORS

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | Primary Responsibilities •Reviewing periodically and making recommendations to our board of directors on the range of qualifications that should be represented on our board of directors and eligibility criteria for individual board membership. •Seeking, considering and recommending to our board qualified candidates for election as directors and approving and recommending to the full board of directors the election of each of our officers and, if necessary, a lead independent director. •Reviewing and making recommendations on matters involving the general operation of our board of directors and our corporate governance and annually recommending nominees for each committee of our board of directors. •Reviewing the Company’s strategies, activities, policies, and communications regarding sustainability and other Sustainability and Impact related matters, including our CarbonCount® and WaterCountTM score, and making recommendations to our board of directors with respect thereto. •Annually facilitating the assessment of our board of directors’ performance as a whole and that of the individual directors and reports thereon to our board of directors. The specific responsibilities of the NGCR Committee are set forth in its written charter, which is available for viewing on our website at www.hasi.com. In February 2024, our board of directors amended the NGCR Committee charter to delegate to the NGCR Committee the responsibility to (1) advise management regarding strategic human capital initiatives, including leadership succession, talent development and progression, recruiting, retention and culture, (2) review and monitor the development, implementation, and effectiveness of the Company’s practices, policies, and strategies relating to human capital management as they relate to the Company’s workforce generally including, but not limited to, policies and strategies regarding recruiting, engagement, retention, employee learning, career development and progression, succession planning, corporate culture, and employment practices, (3) coordinate with the Company’s Compensation Committee to assist our board of directors in its oversight of the Company’s practices as they relate to the Company’s human capital management with respect to the Company’s compensation plans (e.g., retention, talent management, and pay equity practices), and (4) review and discuss with management the human capital management disclosures, as required, for the Company's annual proxy statement or annual report on Form 10-K and determine whether to recommend to the Board that such human capital management disclosures, be included in the annual proxy statement or annual report on Form 10-K. Independence Our board of directors has determined that each of the members of the NGCR Committee is independent as required by the NYSE listing standards, the Guidelines, the Independence Standards and the written charter of the NGCR Committee. | |

| NGCR Committee Current Members Teresa M. Brenner (Chair) Clarence D. Armbrister Michael T. Eckhart Charles M. O’Neil | | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | Primary Responsibilities •Assessing, monitoring and overseeing matters relating to the Company’s financings. •Discussing and reviewing policies and guidelines with respect to our risk assessment and risk management for various risks, including, but not limited to, our interest rate, counterparty, credit, capital availability, refinancing and certain environmental risks. •Reviewing and assessing the adequacy of our insurance coverage. •Reviewing and assessing the adequacy of our cybersecurity policies and programs. The specific responsibilities of the Finance and Risk Committee are set forth in its written charter, which is available for viewing on our website at www.hasi.com. Independence Our board of directors has determined that all of the members of the Finance and Risk Committee are independent under the NYSE listing standards, the Guidelines, the Independence Standards and the written charter of the Finance and Risk Committee. | |

| Finance and Risk Committee Current Members Charles M. O’Neil (Chair) Clarence D. Armbrister Michael T. Eckhart Nancy C. Floyd Kimberly A. Reed | | |

| | | | |

| | | | | |

18 | HASI Proxy Statement 2024 |

BOARD AND CORPORATE GOVERNANCE STRUCTURE

SUSTAINABILITY AND IMPACT OVERSIGHT

Sustainability and Impact Oversight

We recognize the importance of understanding, evaluating, and monitoring Sustainability- and Impact-related opportunities and risks as part of our vision and strategy. The NGCR Committee is responsible for periodically reviewing our strategies, activities, and policies including our Sustainability Investment Policy, Environmental Policies, Human Capital Management Policies and Human Rights Statement.

| | | | | | | | | | | | | | |

| | | | |

HASI Board of Directors NGCR Committee President and CEO Sustainability and Impact Leadership Team |

HASI Foundation Leadership Team | | Sustainability and Impact Reporting Frameworks Committee | | Diversity, Equity, Inclusion, Justice, and Anti-Racism (DEIJA) Working Group |

| | | | |

| | | | | |

| ROLE | RESPONSIBILITIES |

| Board of Directors | Formal adoption of Sustainability and Impact strategy and policies and oversight of implementation |

| NGCR Committee | Recommendation of new Sustainability and Impact policies and oversight of implementation |

| President and CEO | Prioritization and oversight of staff and company resources dedicated to the implementation of Sustainability and Impact initiatives |

Sustainability and Impact Leadership Team | Reports to the Executive Chair, CEO and Nominating, Governance, and Corporate Responsibility Committee and is responsible for informing strategy, setting performance milestones, and designating responsibilities |

Strategic Initiatives, Sustainability and Impact | Development of Sustainability and Impact strategy, execution of initiatives, and integration of engagement with relevant rating agencies, Sustainability and Impact-focused investors, and other stakeholders |

| Accounting | Tracking, verifying, and reporting Sustainability and Impact (including PCAF-aligned emissions metrics) metrics in public financial filings |

| Legal | Review of sustainability and impact disclosures and ensuring validation of adherence to Sustainability and Impact policies |

| Human Resources | Development and implementation of DEIJA principles in employee recruitment, retention, promotion, and engagement initiatives |

| HASI Foundation Leadership Team | Development and implementation of corporate philanthropic strategy |